Legacy financial messaging standards are fragmented, inefficient, and lack structured data, leading to high costs, manual processing, and compliance challenges. As real-time payments and regulatory demands grow, there is a need for a standardized, data-rich framework. ISO 20022 solves this by enabling seamless, automated, and transparent financial transactions globally

What is ISO 20022 & why is it important?

ISO 20022 is the latest global standard for payments related electronic data interchange between financial institutions. This unified standardization approach provides a common methodology, process, and repository for financial messaging across various domains, including payments, treasury, trade services and foreign exchange. The primary driver for this shift is SWIFT's decommissioning of MT Series 1 and 2 messages in November 2025, compelling financial institutions to adopt ISO 20022, ensuring seamless cross-border payment processing. While compliance is a major motivator, ISO 20022 also enables broader payments transformation by supporting richer data, enhancing efficiency, and unlocking new value-added services.

What are the compliance needs? How are banks addressing it?

Financial institutions globally are working towards ISO 20022 compliance to meet the mandates set by various regulatory bodies and payment networks. With the end of the coexistence period for the older SWIFT MT standards and the ISO 20022 messages in November 2025, financial institutions must upgrade their systems to support the new standard. The decommissioning of MT messages by SWIFT necessitates that all financial institutions be ready to send and receive ISO 20022-compliant messages to avoid disruption to cross-border payment transactions.

Many banks have begun to address ISO 20022 compliance by typically following either of the options:

- Channels, Middleware, Core & Other surround applications: End-to-End modernization

- ISO 20022 translator: Code-less integration with bank’s infrastructure

- Payment Hub: Centralized platform for payment processing

Depending on the chosen route, the complexity of changes to existing systems and infrastructure varies, along with a strategic shift in how data is managed and utilized.

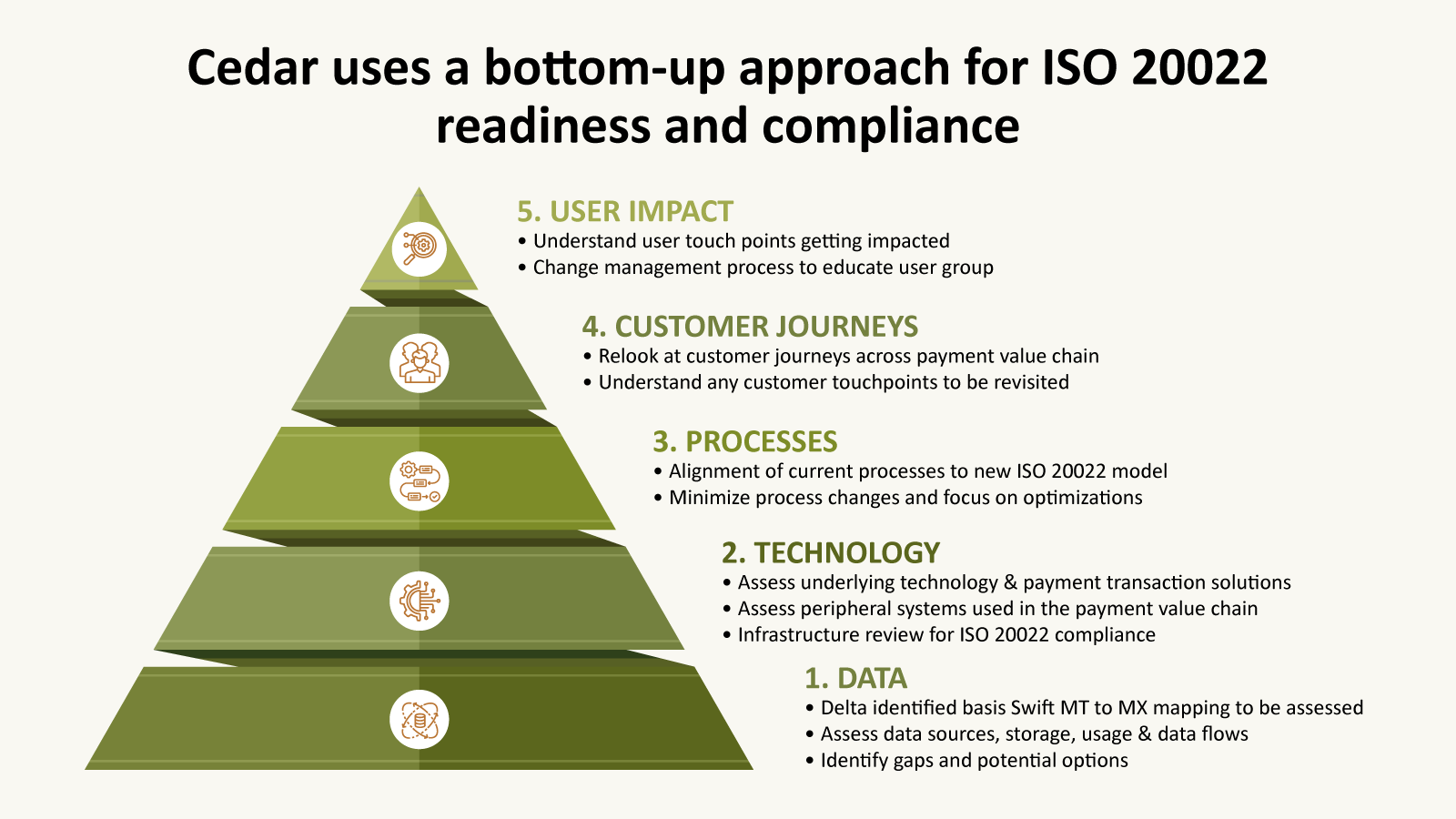

What are the elements that need to be addressed (Data, Tech, People-Customers & Users, and Process)?

Successfully transitioning to ISO 20022 requires a holistic approach that addresses several key elements - Data, Technology, Process & People:

- Data: Assess the differences basis Swift MT to MX mapping. Review data sources, storage, usage, and data flows to identify gaps and potential options.

- Technology: Assess the underlying technology and payment transaction solutions, as well as peripheral systems used in the payment value chain.

- Processes: Align current processes to ensure ISO 20022 compliance and minimise process changes while focusing on optimisations.

- People: Understand user touch points and implement change management processes to educate user groups, and consider customer journeys across the payment value chain

How can Cedar help?

With deep experience in business, operations and technology transformations, Cedar has a well-defined framework for ISO 20022 (Nov 2025 deadline) readiness and compliance which typically involves:

- Diagnostic review: Review of existing payment applications to assess compatibility with ISO 20022 standards. Evaluate system capabilities and messaging formats to determine readiness for compliance

- DTPP (Data, Technology, Process, People) validation: Leverage the Cedar framework to evaluate readiness across Data, Technology, Process, and People (DTPP). Identify critical gaps and define corrective measures

- Assurance Validation: Review current initiatives and roadmaps, timelines and dependencies, and identifying key risks and mitigation strategies.

The result is comprehensive detailed guidelines with key recommendations, assurance measures, governance mechanisms, and validation steps to ensure a controlled and successful migration to ISO 20022.

What is the Value Realisation from ISO 20022?

Beyond compliance, ISO 20022 offers a significant opportunity for value realisation. This involves identifying scope for optimisation of payment architecture, efficiency improvement through automation and STP (Straight-Through Processing), and product enhancement by leveraging ISO 20022 enriched data. It also gives the opportunity to define use cases for value-added services such as enhanced remittance information, real-time analytics, and personalized payment solutions.