Shifting to a future-proof Digital Core Banking System is essential to speed up innovation, meet changing customer needs and swiftly respond to the changing environments

Traditional core banking no longer provides the required customer experience to acquire, retain and grow customers. Many banks are behind in making the critical end-to-end digital banking transformation due to a variety of legacy systems and fragmented data. Banking institutions must now establish a more holistic customer experience approach and underlying digital transformation strategy – referred to as “Digital Core Banking.”

Core banking modernisation is driven by higher client expectations, changing environments, and technological evolution.

Key drivers for core modernisation

Clients are increasingly demanding services that are personalised and efficient. They want access to services and solutions digitally, using the devices they prefer, within the time frames they want. Therefore, the focus should be on front to end digital transformation and enabling seamless customer-centric servicing that delivers the right interaction at the right time via the right channel.

There is a fair chance banks have already adapted the fancy app and website with feature such as chatbot or AI, but true digital transformation cannot happen just at the channels as often the core technology is too rigid and too slow to support customer needs. Banks have started to understand that digital transformation can only happen when digitisation is used throughout a bank. To become truly digital, banks should also invest in replacing the core universe to meet higher client expectations and adapt more quickly to changing environments some of which may not be presently known.

A flexible core system built on modern technology can mean the difference between success and failure for most banks. Regardless of size and geographical location, banks need to be able to quickly launch new products, address the increasingly demanding needs of customers and regulators, and operate as efficiently and cost effectively as possible.

The Core Banking system of the Digital Age

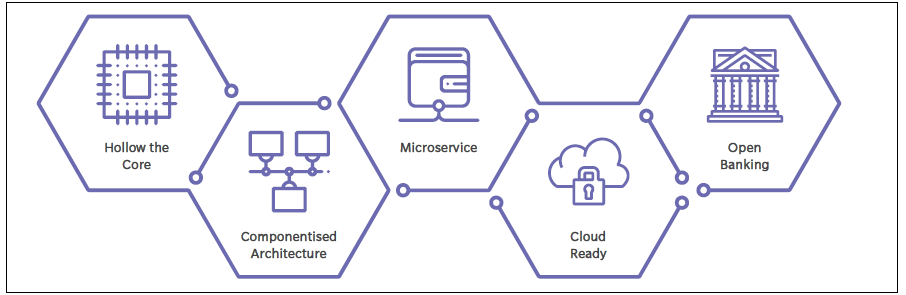

The Digital Core Banking Universe which a bank should focus on to fully transform from Legacy Core to the Core Banking System of the Digital Age consists of key principles: Hollow the Core, Componentized Architecture, Microservices, Open Banking and Cloud Readiness.

Hollow the Core

A complex monolithic core is not only expensive to maintain but also makes it increasingly harder to adapt quickly to meet new consumer needs and regulatory requirements. The primary purpose behind the concept to “hollow the core” is to have core banking platforms solely act as systems of records or posting ledgers.

New capabilities or customisations specific to bank or region should be build outside the core. The mantra for the new core is literally zero customisations, ensuring standard offering of the product explained or demonstrated to the business. The approach to Hollow out the Core or abstract the domain capabilities from the product processors offers greater flexibility and innovation and enables IT teams to set up platforms for a modern, ready-to-use design powered by latest, best-in-class technological solutions.

Componentised Architecture

A Digital Core Banking system is a comprehensive, componentised platform of retail and corporate banking solutions with the freedom to choose products that match the bank’s business priorities, and offers the flexibility to decide when to deploy or upgrade a component.

The next generation banking solution offers discrete and smaller components with eventual flexibility. Componentised modules extendreal-time digital processing capabilities and the potential of banking modernisation opportunities while continuing to feature the core banking product innovation, processing ability, security, performance and reliability.

Component-based architecture incorporates standalone configurable components instead of functionality usually embedded in channel applications across the business. This approach allows banks to protect existing IT investments, releasing capital for innovation and enhancements that attract and retain customers. The component-based approach to core modernisation will facilitate customer-focused, agile business processes; and renovate product and service offerings, and related pricing.

Microservice

The banking software industry has reached another milestone with the rollout of functionally rich, microservices-based architecture that can strategically transform banks’ core banking systems at scale and revolutionise banking. Unlike legacy monolithic core banking systems, microservices are independently deployable functional APIs that are cloud-native and cloud-agnostic with tangible benefits.

Core banking microservices can be deployed autonomously in the enterprise and banks can retain existing systems where they are fit for purpose. Microservices enable banks to offer an agile, services-based architecture for banking applications and digital customer journeys.

Choosing a microservices strategy offers banks the benefit of granular upgrades, allowing them to react to market opportunities faster while cutting the total cost of ownership of their existing core banking platform, such as building extensive set of standalone microservices services for Payments, Dedupe, Fraud Management, Account and Deposits, Lending, Product Catalogue, Pricing and Analytics.

Cloud Ready

Cloud-based core banking is still relatively new, but it is set to become more mainstream. Cloud computing is a proven solution to many core banking challenges, such as interoperability, 24x7 availability, security, and also scalable storage. Despite these benefits, banks and financial institutions still show reluctance in adopting cloud-based offerings, citing potential security concerns over data leaks. However, state-of-the-art SaaS solutions offer a level of security that meets or surpasses on-premise solutions.

Opting for a SaaS platform enables you to spend more time and money on the parts where you can make a difference for your clients instead of focusing on IT, security and operational issues. We believe that a cloud-based core banking platform is essential. In fact, we can say that effective adoption of the cloud will be a critical factor in deciding who emerges on top and who falls behind their competitors in this new age of digital core banking.

Migrating core banking systems to the cloud presents banks a rare opportunity to achieve conflicting objectives at once: reducing costs while increasing agility, flexibility, and scalability. Hardware and software components should be designed to maximise the offering in the cloud. Cloud-based banking enables you to accelerate growth and automate operations and workflows. This results in increased efficiency, security and reduced cost. You can refocus your resources to better understand and serve customers, rather than maintaining old technology or managing difficult integrations to legacy systems.

It has become clear that any financial institution relying on legacy infrastructure and architecture cannot compete against more innovative digital competitors. With the right cloud platform, the bank is ready to serve customers and rapidly respond to new products and services. We believe the time has come to move core banking processing to the cloud, and it should be on the minds of all architects and banking executives.

Open Banking

Open APIs serve as a bridge between Core Banking components to connect banks with the FinTech ecosystem in providing better customer service, enabling end-to-end straight-through processing and helping banks to shrink their legacy footprint in lieu of lightweight architectures built on microservices and the cloud.

Too many banks have been ignoring FinTech competition for quite some time, hoping it would go away! The Payment Services Directive 2 (PSD2) requires banks to release customer data in a secure, standardised form, to be shared among authorised organisations online. This part of open banking makes it possible to pass customer information to third parties, who may use this data to create new products. It’s a way of enabling customer data sharing— if they give their consent — to enhance competition between the banks.

Thanks to open banking guidelines, a vast number of transactions in the future will flow through channels owned not by banks but by third parties and technology firms in the new enterprise ecosystem. Customer experience is the top priority and it is likely that, with the future exponential growth in volumes brought about by the digitisation of banking, banks may struggle to operate and compete on legacy architecture. Open banking presents a unique opportunity for challengers where customers can easily switch banks to take benefit of better products and lower fees. This leads to the opening of competition between banks, FinTechs and other services providers with customers switching easily between providers.

Conclusion

Legacy core banking systems have been constantly modified to deal with changes in business practices, with result that such systems have become more complicated to manage. Banks must explore the Digital Core Banking Universe meticulously to modernise their core banking system.

The journey to core modernisation will take time. Those planning to start this year should expect the incremental Digital Core Universe to be fully realised in 3-4 years. The typical model allows 6-12 months for planning, preparation, and pilot programmes, and 2-3 years for implementation.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View