Every digital transformation is looking to address a fundamental shift, both from

the customer's perspective, and also with the internal processes and organisational

models. What are the elements that differentiate a robust design of a digital-ready

bank against others?

With so much being said, written and debated about digital journeys and transformations and the benefits they drive, the question that still deserves an honest answer is this: do all digital transformations programs necessarily result in achieving their intended goals? There are several global banks that have suffered from, or are being challenged by, the growing expectations on digital performance that are simultaneously also constrained by ground realities. When digital banking does not necessarily drive customer satisfaction, more often than not there are a few obvious – but addressable – reasons that are key to look out for.

The estimated spend on digital transformation globally is expected to grow to $2 trillion in the next three years, even if we reckon that only 20% of that is in the financial services space. In all fairness, the digital transformation journey cannot be principally different from any other transformations if one looks at it from the lens of its ultimate objective of driving change, and therefore the success factors that are embedded therein can be quite similar too. At the same time, there are dimensions that can be quite different from other transformations that need to be borne in mind – an example of this being NAB’s decision to reduce 6000 roles (source: IBS Intelligence, November 2017) as they automate and simplify the business model, even while 2000 new jobs are being created to enable the workforce to deliver the 2020 plans. Now those kind of dual hire and fire approaches are somewhat unprecedented, and that’s where digital transformations need to be dealt with differently

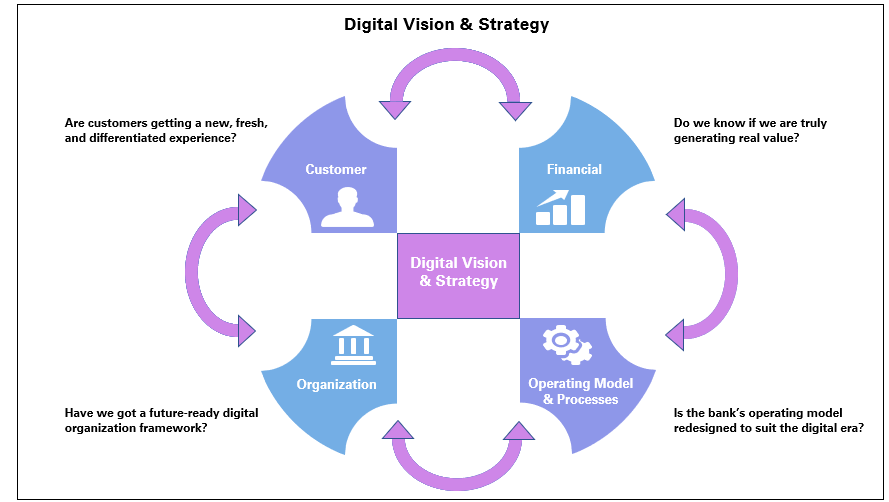

So what are those key questions, whose definitive answers can stand the test of a digital banking transformation? Here are four key success factors that are aligned with the Balanced Scorecard framework that we at Cedar-IBS believe are critical for any CEO if the bank is on a digital transformation journey.

1. Are customers getting a new, fresh and differentiated experience?

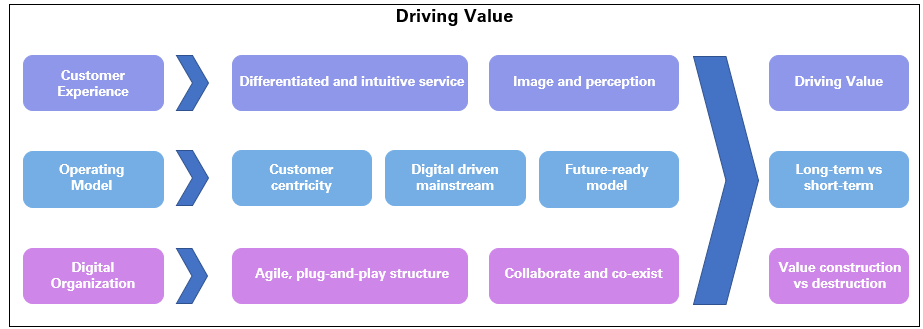

If more than 80% of the mobile penetration is likely to be smartphones in the next three years, and customers are looking to get all their banking at their fingertips (pun intended), then it is not about just offering that service to the customer that makes you the bank of choice, but being the most interesting, differentiated and intuitive service provider that gets the customer’s attention. Getting the right “Design Thinking” with simplicity at the core of the services model is the key success factor here. For instance, when an app is used to convert your phone into a bar-code reader that automatically charges items to a credit card without having to pay at the retail checkout, we are just not talking about convenience, but an altogether new customer experience that the bank (Barclays, in this case) is looking to offer.

"A new paradigm of a

digital end-state is likely to

emerge in the next few years"

It’s not just about digitising the customer touchpoints and driving coherence with omnichannel banking, but about everything to do with banking. It is about getting all channels, data, technology, and operations to converge on driving a better customer experience (CX). Industry estimates peg a 2-3% growth in revenues for every increase in the customer satisfaction decile. CX is a function of ease, speed, transparency and above all, the ‘wow’. And that is where the digital bank can score, as evidenced by a higher NPS with digital first banks. Value perception driven customer experience is also a key factor here, and it pays to invest in building an image, although it is critical that the delivery framework lives up to the claim.

2. Is the bank’s operating model redesigned to suit the digital era ?

From being product centric to process and customer centric, there have been multiple theories that define the central theme of every operating model. However, what would be critical for thriving in a digital era is about weaving technology and a digital thought process around everything.

More and more banks adopting their process framework in accordance to “digital customer journey maps” is an evidence to this. Product design and development, driving new-age innovation in services, mainstream customer engagement and everything to do with back-end process will be re-oriented to fit with the digital agenda. It’s no longer about anywhere, anytime, but also about any-device, and therein lies the real essence of the transformation.

If Social, Mobile, Analytics and Cloud (SMAC) does not constitute as primary vocabulary of the strategic roadmap of a bank, chances are that digital is not at the centre of gravity, and the bank sees this as another initiative. And if digital is just another initiative in the long-list of projects run by the bank, or if it is another business line for the bank, then chances are that the operating model they are currently delivered in is unlikely to last very long. If 80% of urban millennials already believe digital banking is the primary way to a bank, then the default operating model – the design for the end-game – will need to be digital in catering to that audience too.

So what happens to the branches? Well, just say that they exist to serve the purpose in the new scheme of things. As the customer profile transcends across generations over the next 10 years, and as smartphones grow into being a one-stop-do-all device, and branches become more flagship promoting digital experiences embedded in them, a new paradigm of a digital end-state is likely to emerge in the next few years. JP Morgan’s focus on building self-service kiosks and card issuing machines in branches, or Wells Fargo building video call technology for customers to speak with its personal bankers are examples of what branch banking will become in the days to come.

3. Have we got a future-ready digital organisation framework?

It may not just be enough to do a lip-service on having an agile organisation. A true future-ready digital organisation framework would be about driving that spirit both in thinking and doing. For example, the roles and responsibilities of a manager can be different between an agile and a waterfall development model, and attempting to have both co-exist may paralyse the functioning of the team. Driving innovation-inclusivity with the team, and having an agile framework that can plug-and-play with multiple outsourced entities is emerging as a dynamic ecosystem that allows for digital innovation promoting both collaboration and co-creation.

An interesting example is Capital One’s initiative to institutionalise design thinking and lean startup learning across the organisation, and accelerate the enterprise-wide digital agenda with a stimulating environment for ideation and customer experience enhancement. Banca Intessa, an Italian bank based in Turin has invested in a digital learning process that is based on a Netflix app, driving an active engagement by 100,000 employees. The bank won the Workforce Empowerment and Behaviour award for a digital learning portal.

Time-to-market is key, and any framework that dilutes this proposition is unlikely to sustain. Having long cycles of planning, developing, testing and rollouts are passé. The new-age thinking is about prototype-driven minimum viable products (MVP) and scaling those that pass the smell test. To get this going, we are looking to have banking business experts, UX designers, IT development team and quality assurance professionals to work in tandem, and having a cross-functional innovation team of a different order than what we had 10 years ago. The spirit of agile models is in making things faster, dynamic and effective. This also means easier adaptability, real-time interface and promoting online-virtual communities that are complementary and yet not bound by geographic restrictions. More importantly, both enterprise and individual performance measurement framework would need to be realigned with changing priorities as well.

4. Do we know if we are truly generating real value?

A boardroom conversation of a bank is incomplete if it has not expressed its concern with growing micro-loan fintech players or peer-to-peer crowdfunding models, and the advent of robotics and artificial intelligence defining new ways of financial advice. Yet, it is also true that not every board member relates to the value that is in store from a next-generation digital world. A typical passive approach to board approvals on digital transformation are two forth: a) Being relevant: If you’re not on the digital map, you don’t exist; and b) Staying ahead: Not being the first to offer is as good as no offer.

Defining a value proposition is a function of distinguishing between customer segments that are primary today as against the segment that would be centre-stage tomorrow. The hallmark of a digital model is also about differentiating the value drivers for each customer segment based on what is critical for each of them.

This also has another connotation: being digital also comes with the responsibility of safeguarding against the new-age risk factor – cyber security in particular which can create havoc if not pre-empted. Customer data, drivers of relationship and information assets are sources of value, and losing them to intruders can bring any bank to its knees, if not protected vociferously. With regulatory norms also increasing by the day, the cost of compliance can also go up steep in the digital era.

However, the real case for a digital transformation can be, and needs to be, much more than this. This is essentially driven by where we visualise the organisation to be over the next three-to-five years and what that would mean to the shareholders from a value perspective. And what does it take to reach there, including key changes that need to be driven?

Fortunately, most of the changes are driven by what is adaptable from an immediate standpoint. The digital paradigm, as they say, is all about driving long-term vision but with a short-term execution. Launching digitally innovative products, driving digital adoption by the customer, improving digital process framework and building a digital-ready organisation are all means to a larger end: is there value created – either with increased business, or with reduced costs? Ultimately, the proof of the pudding is always in its eating – and for once, this had better be real and not virtual!

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View