Treasury has emerged from a back office function to critical value-adding status, observes

The evolution of sophisticated investment options, tightening regulations and transformation of banks’ business models have led to an expectation for the treasury function to be far more effective in contributing to both the topline and bottomline.

The traditional goal of treasury was to manage liquidity while maximising the return on investment from assets. However, post-financial crisis, the risk management capabilities of banks’ treasury functions have come under scrutiny. Previously, a significant number of treasury functions could be performed through homegrown solutions such as Excel databases. But this approach led to limited transparency and introduced significant risks. Bank CEOs and regulators now expect a greater level of visibility and insights. This calls for a best-inclass Treasury Management System (TMS) to allow banks and their treasury departments to communicate with banking partners, vendors and customers in real-time.

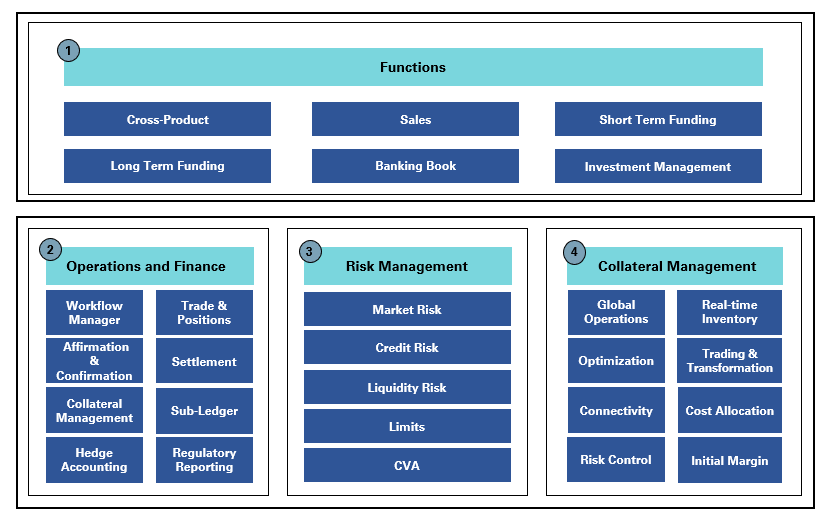

Treasury functional architecture

TREASURY KEY INFLUENCERS ON TECHNOLOGY TRANSFORMATION:

• Automation of banking:

Most banking functions are supported by sophisticated technology platforms, so it is imperative for treasury functions to be automated. Also, banks require integration with core banking and ERP systems to improve data management capabilities

• Globalisation:

For example, treasury systems require integration with SWIFT to support high volume transactions

• Outsourcing:

Due to increasing levels of complexity, banks are upping outsourcing of non-core treasury functions. This is leading to increased workflow and document management requirements. For instance, there has been a trend toward using SaaS/ASP solutions

• Regulations:

New regulations are impacting a treasury department’s compliance activities. FBAR and FATCA are two such examples of this

• Need for analytics and decision-making:

Banks are developing data warehouses to improve analytical reporting on their businesses. This has resulted in higher expectations on the data management capabilities of the TMS In addition, technical factors such as scalability, performance, security and product roadmap must be considered.

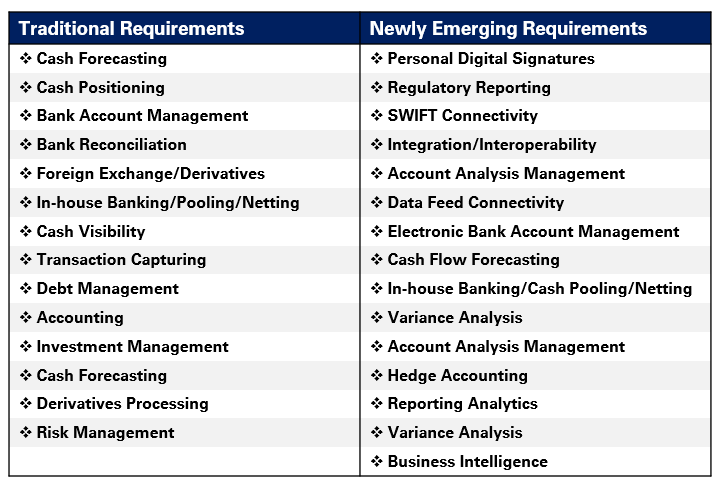

EVOLUTION OF TREASURY SYSTEM FUNCTIONAL REQUIREMENTS

Execution is key

Selecting the right TMS is key for successful technology transformations, but is by no means the final step. Successful Program Management is equally important.

Integrated planning:

TMS implementations invariably coincide with other technology transformation projects. TMS has dependencies with both upstream systems (e.g. core banking) and downstream systems (e.g. Business Intelligence). Therefore, it is necessary to ensure integrated planning of all transformation initiatives

Well-defined scope:

Successful IT implementations require close involvement of functional users, but treasury departments are usually small in headcount, and so a well-defined scope is necessary

Effective program governance:

Enterprise functions such as finance and risk management need to be engaged in the governance of the TMS implementation

Effective change management:

The transition to a more structured way of working is a challenge for most business functions, particularly for a nonstandardised function such as treasury

To successfully achieve technology transformation, banks should ensure the following three enablers:

Alignment with the bank’s overall operating model, effective prioritisation of requirements and effective program management of the TMS implementation

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View