Corporate payments have evolved significantly over the past few years, enabled

by modernised technology platforms. These developments are helping corporate

payments get close to real time, while improving transparency and compliance

Banks are expected to make significant investments in corporate payment technology to remain relevant for corporate customers and ward off the threat from upstart fintechs that offer disruptive innovations. The payment services offered by banks globally are becoming the most important source of revenue for them, as well as drivers for customer retention. While the advancement in digital payments, including mobile wallets and contactless cards, has revolutionised the experience for a retail consumer, the corporate set-up is not far behind, with increasing focus on real-time integration and improved efficiency of corporate payments.

While the consumer payments domain has seen rapid innovation, driven by fintech companies that increasingly focus on addressing only one problem statement at a time, the corporate payment landscape is still evolving, with advancements in payment integration capabilities, regulatory compliances and greater security. Banking for corporate customers has transformed over the years, but some inherent challenges remain. Banks and other financial institutions are in dire need of upgrading their relationships with corporate customers by putting technological innovation in the field of payments space at the forefront.

Banks – having seen innovation in the field of retail payments – forge ahead at a pace that was unimaginable 10 years ago and are therefore increasingly directing their focus on aligning their corporate banking infrastructure to keep up with this pace. If banks themselves do not act fast to snatch the opportunities in the corporate payments space, some of the emerging start-ups in the financial technology space will, leaving banks behind.

There are seven key trends globally, that are reshaping the corporate payments space.

1. Payment hubs

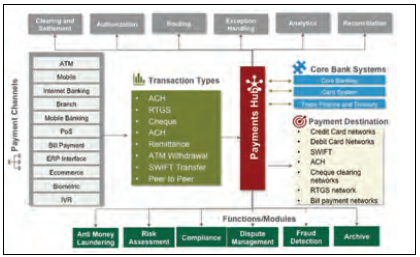

A legacy of disparate IT systems running across departments coupled with the need for data integration for real-time reporting purposes, is driving the banks to adopt the Payment Hub as a solution. Most Banks rely on standalone transaction processing systems that are confined to specific capabilities such as wire transfer, EFT, cheques and so on. These systems usually work in silos using obsolete or ageing technologies, making the support and maintenance expensive by the day. This eventually restricts banks to respond swiftly and efficiently to changing corporate and market condition. Also, it not only hinders efficient payment processing but makes data collection and processing a mammoth task. Payment hubs, which are a first-hand implementation of a Service Oriented Architecture (SOA) concept, allow consolidation of services into clusters, thus providing unified and standardised interfaces. It moves away from a silo view to a single consolidated view for the end consumer. Migration to payment hubs allows banks to move to industry-standard messaging interfaces, allowing integration with different channels and vendors.

2. ERP integration Manual payments across channels and disparate systems can lead to inefficient processes, which could lead to consolidation efforts, delayed payments and increased business opportunity costs. Integration of the Enterprise Resource planning (ERP) system of an organisation leads to significant time saving and efficiency of operations spent in processing payments. Integration of the ERP systems with the bank services essentially eliminates the need to manually track and reconcile payments and receivables with the account statements. Since such an integration is an end-to end Business Process Engineering (BPE) cycle, the hidden costs involved, along with the impact of core process can be substantial, if the best practices and best in-class solutions are not adopted.

Payments infrastructure connects channels, applications, core

systems and destinations

Globalisation in the past few decades has led to the advent of internationally scattered supply chains where procurement as well as production has been moved to emerging or low-cost markets. Corporates are aware of the inherent risks associated with global supply chains where procurement or supply of critical components is dependent on third party suppliers. Supply chain financing aims to minimise these risks by the use of financial instruments and technologies for optimising the working capital and liquidity. Recent innovations in the space include invoice discounting, dynamic discounting and reverse factoring.

4. Local payment services

Growing penetration of internet, ecommerce and digital payments is driving the trend for the need of local (region specific) payment methods for financial service providers. Expanding to newer geographies means the merchant and the payment processor need to adapt to the local payment options familiar to the end consumer. Existing traditional payment methods from outside a region may take time to establish.

E-commerce today is a global phenomenon that is highly dependent on local payment methods. Effortless checkout with integration of local payment options adds a factor of trust.

Government and central banks are coming up with payment initiatives to make the payments domain more robust, secure and interoperable. The national payment corporation in India recently launched the “Bharat Bill Payment Service” to bring all the billers on a single platform, while the PSD 2 initiative in Europe aims to integrate payments across the European Union to build efficiency.

5. Blockchain

Corporate and financial institutions could leverage the underlying infrastructure of Bitcoin to facilitate payments. The conceptual framework of blockchain could not only reduce significantly the risks associated with payments but improve the speed of transaction and provide real time monitoring capabilities. Ripple and Smart Contracts are only two of the initiatives that use the block chain framework and which are garnering global traction from banks and financial institutions.

In the early stages of implementations, the block chain setup could be limited within an ecosystem of trusted parties that could include the organisation, trusted pool of supplier and buyers and the bank. As the platform grows into a more robust and secure means, the ecosystem could be expanded. Blockchain technology, although promising, has some inherent challenges – for instance managing the ever-increasing length of the blockchain or complying to the regulatory requirements.

A live use case of blockchain in Cryptocurrencies is Bitcoin, which still faces many regulatory challenges as there is a need for a regulatory framework for messaging standards, risk assessment and classification as a currency or a commodity.

6. Open banking APIs

The emerging trend today is of open banking and open payments where banks are opening their APIs and allowing third parties, merchants or corporate to integrate payment functionalities.

The shift towards an open banking ecosystem is driving the API economy to enhance user experience. Banks are using different models to enable open banking, including sandboxes and app stores. For instance, Visa has opened up its retail payments network as an API. With unlimited access to banking capabilities, fintech will eventually lead the transformation of banking domains, enabling greater autonomy of operations.

7. Regulatory compliance

The increasingly complex regulatory landscape has challenged the corporate payments landscape. There has been increased focus on KYC, anti-money laundering and terrorist financing, resulting in a need for end-to-end compliance solutions.

The most convenient and obvious means of tackling such instances is customer identification and efficient management of high-risk customers. The banking and financial services industry is responding to this by focusing on information governance and data security solutions that aim to create inventory of high-risk customers. Eventually, the AML compliances focus will migrate to making sense of large volumes of data, eventually leading to a Big Data approach for AML fraud detection and KYC.

With the more sophisticated requirements for corporate payments, the ability of banks to ensure a seamless experience of payment transactions to customers is a critical differentiator for banks. We are likely to see significant investments by banks to upgrade corporate payment capabilities, and a number of new suppliers will emerge to benefit from these opportunities.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View