Omnichannel has been a buzzword extensively used in recent years when it comes to discuss about marketing strategy. Banks have widely embraced the transformation into an omnichannel-based model for corporate and retail banking to different extents across the globe, as one of the key levers to boost customer experience and ultimately increase profitability. Its adoption dates back to 2010s. It can be defined as a cross-channel strategy to provide seamless user experience across multiple points of contacts. In essence, omnichannel is focused on increasing sales while reducing their cost and improving the quality of customer service.

Rather than working in silos (which occurs in multichannel), channels communicate and share data of customer journeys, allowing seamless customer experience, eventually ensuring consistency of submitted information and of prices across all channels.

A typical example is the one of customers who initiate their loan request in the branch and finalize the same on their tablet. At any point in time, clients are able to monitor the progress of their request by checking the approval stages, or to continue the application process by submitting any needed information remotely and interact with the bank through any available channel (ATMs, ITMs, smartphone, online banking, wearables, tablet, mobile and IoT devices).

There are several factors that organizations consider prior to embarking into an omnichannel strategy, including assessing their technological readiness, analysing the behaviours of existing clients and prospects, understanding operational and organizational impacts.

Data analytics are key not only to define the strategy, but also to steer it once implemented. Monitoring how customers behave through all touch points is crucial for effective and prompt decisions.

If we look more practically at the opportunities for retail banking in the world, it’s worth having a look at the distribution of digital customers, as they represent the flywheel for retail omnichannel usage. Their number is on the rise across the globe as behaviours are changing. As of 2019, Europe and Australia have been the market regions with the highest percentage (50%) of “fully digital customers”(those registering less than four branch visits and more than one online transaction per year), followed by North America (38%), Asia (30%), South America and the GCC countries (11%).

While some regions have more “fully digital customers” than others, the transition into digital-driven behaviours is happening everywhere in the globe. Looking at the cluster of “hybrid” customers (those who still keep a substantial number of visits at the branches - more than four times a year - and perform digital transactions), the number is impressive: North America (~44%), Europe (~40%), GCC (~70%), Australia (~36%), Asia (~56%), South America (~60%).

It is worth mentioning that deep inter-country differences within the same regions exist (for example, the portion of digital customers in the Netherlands outshines the European average (~77%), and the same can be stated for traditional customers in Asia, with Japan on top of the leader board (~38%).

In this context, the COVID-19 pandemic has fast-tracked the behavioural changes, hence forced banks to enhance their presence on the digital channels. ~60% of world branches have either closed or shortened their opening hours, often introducing fully digital processes by covering typical features such as account opening, remote identification and verification and contactless payments.

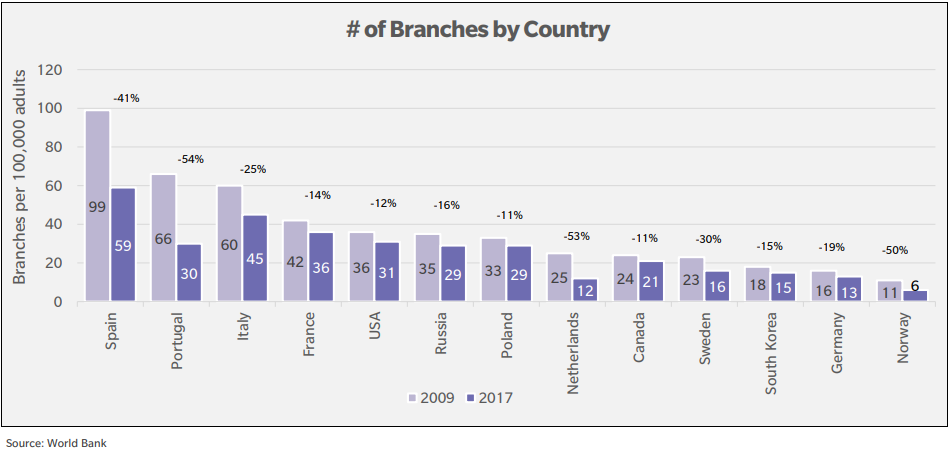

If we look at how this is affecting the physical channel, the reduction of number of branches in the world has taken place at different speeds, as Looking at the future, Banks are likely to revise their physical presence reducing the number of branches and innovating the way they reach out to their customers in a variety of touch points, including fintechs, ecosystems and third-party offerings. Banks will be aware and connecting with their customers’ priorities and interests early before customers actually decide to engage with the banks first.

As customers research financial products on search engines, banks shall optimize their presence on those and be ready to offer their services across channels. In other words, the digital activity out of the banking system should drive the engagement, for instance when a customer assesses the financial feasibility of a loan at a real estate agency or car dealership.

In this context of radical transformation, where the old certainties are fading as customers progressively change their behaviours, omnichannel gives bank the opportunity to deliver their products in a tailored channel mix. For instance, high-wealth customers may feel more comfortable to initiate their application online and end it in person with their relationship manager. It means that defining most suitable customer journeys does not entail to drastically discard the physical channel, but rather to strike a balance in the diversification of the channel mix based on the targeted customer experience, which will ultimately be the driver to meet the targeted client profitability. While we touched upon the implications for retail banking, it is worth articulating what is occurring in corporate banking as well.

Looking at the global market, corporate banking offering is lagging behind retail. Essentially, banks have typically struggled to keep the pace with Fintechs and meet corporate client demands, especially due to tedious onboarding processes for new facilities, new accounts and inadequate digital self-service capabilities. For these reasons, corporates are being heavily dependent on physical channels to execute transaction banking activities.

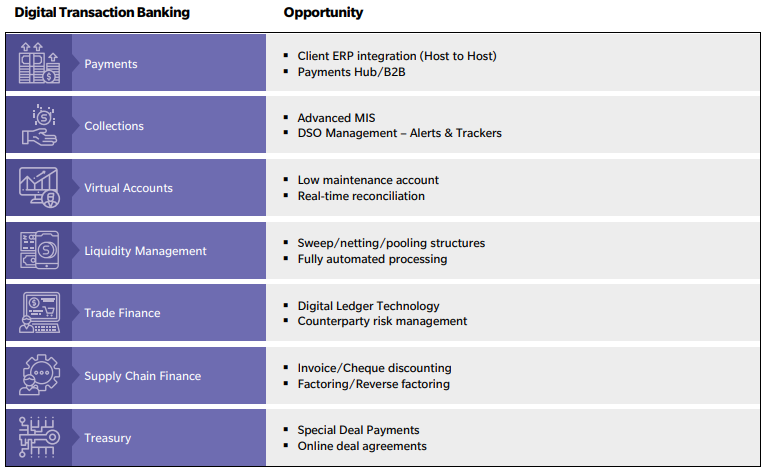

Transaction banking is the area which has been mostly affected by digital innovations. Its domain can be broken down into cash management, trade finance and supply chain services. The main transaction banking capabilities include host to host transactions between clients’ ERPs and bank systems, enhancing authentication options, virtual accounts, remote check printing and automated liquidity management processing. All these capabilities will support corporate treasurers to focus on core financial management and strategic business priorities.

Today, corporates are evaluating their cash management partners, seeking the availability of online and mobile banking tools, which provide streamlined services and faster access to persona-based dashboards while on the move.

The expectation from corporate clients is to get prompt decision support and advice given by analytics-driven insights, with real-time visibility into product portfolio, group structures, transaction statuses, supply chain positions and so forth.

Looking at the future, significant changes in the regulatory environment, combined to new digital offerings, are expected to open up corporate banking to new business opportunities.

The regulatory innovations provided by the new European Payment Service Directive (PSD2) in 2018 are driving the orientation of other regulators across the world, bringing interesting outlooks for both retail and corporate banking services. From open banking perspective, what is at stake for banks is actually more material for corporate services than retail. While banks operate as mere financial information aggregators and tend to provide their service for free in the retail segment, corporates are likely to pay for banking services that will ultimately improve their operational performance. To mention some key capabilities, enterprises can now quickly reconcile their invoices with the transactions occurring on all their banking accounts using open APIs. Several ERP providers in Europe have started to integrate banking reconciliation services in their platforms. In this context, treasurers can aggregate the whole corporate liquidity and manage their assets, with liquidity and credit monitoring services provided by the banks.

Opportunities offered through the adoption of an omnichannel strategy can be material for both retail and corporate banking. Leveraging transformation with new digital offering is key to succeed, but it is not enough.

Data analytics are crucial to understand client behaviours, monitor channels adoption and eventually support the development of customer journeys that increase profitability and add value to clients.

In conclusion, while the adoption of omnichannel started across the banking industry at multiple speeds and at different timings due to market and regulatory differences, global players are expected to be converging to the same track in this fascinating digital transformation journey

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View