Building a digital strategy for a bank is not just about getting the mobile banking app going or rolling out a marketing campaign. The true success in building a digital bank is in the ability to have the right proposition for the customer, building internal capabilities that can help in delivering the right digital experience – ensuring the transformation is embraced both internally and externally.

1. Defining the value proposition

The starting point of any digital journey is in having a customer-centric value proposition. The key question that is core to getting the bank digital ready is ‘what’s in it for the customer?

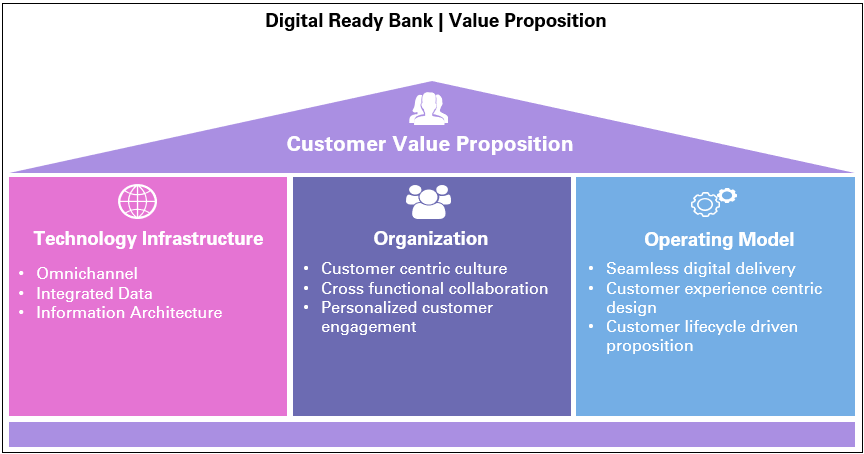

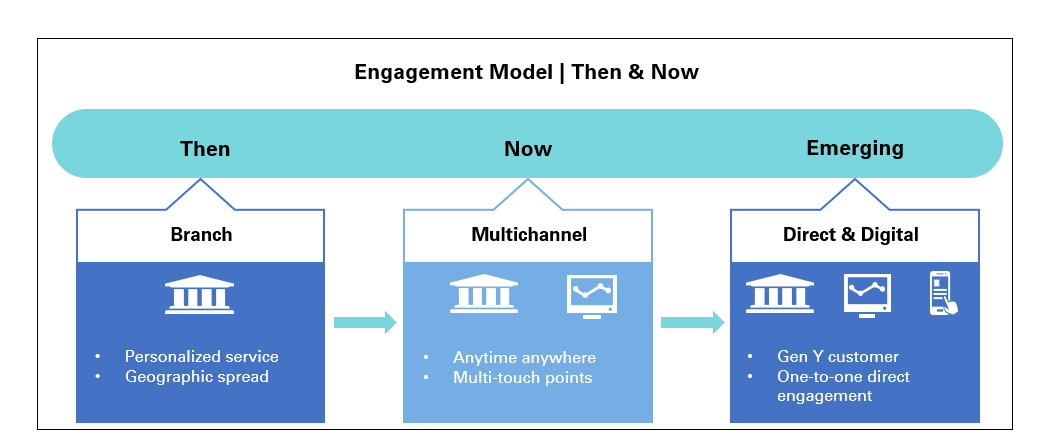

Everything that gets to be created as part of the digital proposition – the technology infrastructure, the organisation capabilities, the operating model – they all tend to converge and create value only when they result in a better experience for the customer. While banks have long moved from being branch driven to being multi-channel, the underlying shift has also been in banks moving away from being product centric to being customer centric

When ATMs came around, they created the first layer of alternative banking channels that helped a ‘self-serviced’ model. With the advent of the internet and mobile banking, the experience moved to becoming even more direct for the customer. We have seen a series of debates over the last decade comparing the highly engaged brick-and-mortar branch banking model with the fast and furious electronic banking models that were rated to be relatively impersonal. 85% of today’s retail banking transactions are now reported to be digital.

Yet today we find banks that are a step ahead on the digital journey have successfully converged the customer engagement levels with digital technology. This enables the pampering experience of a ‘virtual relationship manager’ for customers, and advocates higher engagements with interactive ATMs that provide the customer with a ‘wow experience’

Ultimately, it is the difference that is brought about to the customer and his/her experience that really matters. And there lies the core value proposition.

2. Building the digital technology infrastructure

Channels are the face of the bank to the customer. From just about enabling multiple channels to creating a ubiquitous experience – across branches, ATM, call centres, IVR, SMS banking, internet banking, mobile banking and now social media banking, banks have come a long way in the ability to make the direct digital connect with the customer.

Sitting behind the glamorous channel layer is the core banking platform where the central customer information and the transaction backbone lies: creating myriads of channel connectivity with the core engine is passé. Unless banks invest and build a robust middleware, it would be hard to sustain the digital journey. And that’s the most critical component of a digital bank: and that leads us to the other aspect of digitisation: any bank that is serious about digital technology would need to embrace the emergence of the new beast called data. Decision making processes no longer are driven by heuristics.

Historically, decisions on customer segmentation, product offering, campaigns and sales were driven by demographic profiling and portfolio level analysis. The advent of predictive analytics and big data has taken the science of data and its management to the next level.

The foundation of predictive analytics is in the ability to generate thousands of variables from the static and transactional data that is available with the bank, that help profile the customer behaviour and build statistical correlation that helps predict the way forward and the best course of action.

While loyalty programs gave an opportunity to tap into transaction data that was outside the bank, the advent of social media and the emergence of big data has brought in a plethora of new possibilities. Forward looking banks have created organisations that are increasingly more conscious of this.

3. Nurturing the ‘next-gen’ organisation

No matter how glamorous the face of the bank is, the real digital transformation happens only when the bank as a whole gets to become more digital-aware. And this means more than just training and awareness. It is about a real cultural shift across the organisation

When one of my clients was looking to drive traffic to the newly revamped internet banking channel, we had a very simple solution that fixed it. We had the customer service representatives and relationship managers to invite the customers visiting the branches to actually login to the internet banking portal on a tablet, even while they were waiting their turn at the teller.

The results were astounding. Most customers found the experience of being trained to use the channel so rewarding, and the non-cash transactions volumes moved very soon into the newly launched internet channel, significantly earlier than expected.

The key here was not just about the quality of the internet banking offering. It was also about the banker in the branch being fully well-versed with what its true potential was, and demonstrating that conviction in his/her communication with the customer

Most traditional banks do struggle with this cultural shift – but then there are limited choices there. With the increasing penetration of internet, and the mind-blowing growth in mobile per capita in most countries, banks will need to completely embrace the presence in the digital world even for their survival in the not so distant future.

Presence on social media is a hygiene factor. Yet, if the average banker within the organisation is unaware of the changes happening around, it does create its own challenges in meeting the Gen-Y demands. Remember, over 50% of the world’s population is less than 30 years! And hence the need for building a digitally aware organisation. This calls for a sustained, continuous learning environment across the organisation.

4. Institutionalising the digital operating model

Just as much as how critical it is to have a customer-centric model, it is equally imperative that the operating framework built around it also graduates to a higher digital plane, for the journey to be sustained.

For instance, leveraging customer data is not only about building campaigns with advanced predictive analytics but is also about creating the right customer segments, building more appropriate product offerings, and delivering them seamlessly.

Adapting digital operating model cuts across the bank – right from the sales engine adopting data driven sales automation, all the way to having outsourced fulfilment services leveraging cloud technology.

While technology does serve to the backbone, the real digital banking proposition is in the ability to harness its value in identifying customer needs better, creating and delivering the new age product and service offerings, and in enhancing the end-to-end experience, both inside and outside the bank.

Creating the new paradigm of a digital bank also comes with its share of risks and challenges

The need for increased cyber security and internal fraud prevention systems goes hand-in-hand with greater proliferation of digital technology – one must recognise that the information systems are not only accessed by the bank employees, but also by customers and partners across multiple platforms.

And of course the other word of caution: ‘digital’ is not a destination, but a journey in itself. This is not a one-time project, but a physical, cultural and organisational transformation, and an ongoing one at that. Getting the digital technology in place and creating the right infrastructure only makes on digital ready, and there can never be a point of final arrival.

Changing customer needs necessitates transformation in banking models, but then again, those changes result in a new set of demands by the customer too after all, what came first, the chicken or the egg?!

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View