Although digital transformation is at the top of most banks' agendas, only 55% of ClOs and CEOs lay claim to successful projects

Digital banking Is perceived as a technology initiative; however, technology is a means to an end. Outmost importance are customer engagement and experience that can only be delivered by initiatives which are not necessarily technology driven. There are a few myths that banks must be aware of while developing strategies.

Myth 01: We can Implement the digital 'go-to market' plan in future

The power of computing doubles every 18 months and this is applicable to business innovation as well. How customers transact is also changing fundamentally. Innovation tootled by technology, computing Power and an evolving regulatory framework help FinTechs find cheaper, faster and convenient ways of solving customer issues. II banks do not adapt and offer solutions. customers will find alternatives Banks simply‘annot launch a digital initiative and be complacent, they need to continuously innovate, test new emerging technology and Improvise. Speed to market will be a critical success factor for those seeking to embrace digital technologies.

Myth 02: IT dept can spearhead digital banking

Digital banking implementation is not a piecemeal activity. Rather. II is at the confluence of technological innovation and evolution of banking needs and changes in regulatory adoption These diverse forces are instrumental in shaping the design and implementation of digital banking, which requires an ecosystem of 'enablers' to manage and facilitate its various building blocks. Leadership needs to have commitment and belief and drive the initiative with a strong culture and vision. It can not be initiated in silos, but rather the whole organisation needs to be involved in design and implementation. Along with the leadership team. FIR and transformation departments must also be involved. lust like CRM, many projects do not achieve their true potential it considered as a technology rather than a transformation initiative.

Myth 03: MI Digital banking is about the mobile channel

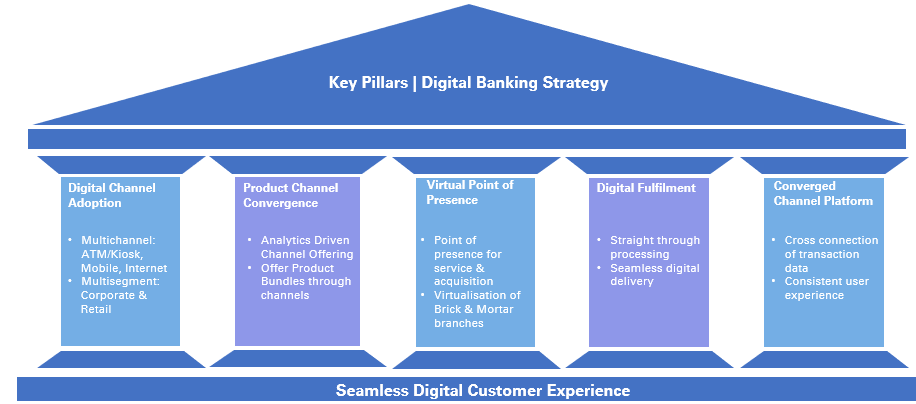

The definition of digital banking often eludes many. Some see it simply as mobile or online banking, some as automation of processes, while others perceive It as electronic fulfilment of services. In a strictly technological sense, it has existed since the 1950s, when the first mainframe computers were used to process banking transactions. However, the meaning of digital has become far more broad and nuanced. driven by several new technological and consumer trends that have combined to create a unique set of circumstances, rapidly reshaping the banking world. mobility, automation, connectivity, Big Data, cloud computing. and artificial Intelligence. Digital banking Is a confluence of five streams (see diagram) covering channel, segment, product, process and technology

Myth 04: Banks need to compete with FinTechs

FinTechs are eager to take a larger share of the banking industry They don't have the traditional strengths of physical presence and massive capital base that large banks enjoy, but they do appeal to Millennia's and high net worth individuals as these groups want fast access to services and are accustomed to smartphones. With limited technology budgets and sluggish bureautrain processes. banks typically are not breeding grounds to' innovation They can partner, incubate and collaborate with FinTechs which often require regulatory licence and a healthy balance sheet to fully exploit their technology's potential.

Myth 05: Analytics for reporting & KYC

Key to digital banking implementation is knowing your Customer. not just from a regulatory KYC perspective but importantly their behaviour. preferences and lifestyle. An important and complex element is identifying which customers are going to spend the most money over the longest period and what products most suit their needs this is the kind Cl insight that lets companies optimise their marketing efforts to target the most valuable segments. Giving a personalised engagement experience is key to the success of digital banking. This can only be built on a better understanding of customers Predictive and cognitive analytics techniques open several avenues and tools that banks can use to gain better insights into consumers and their prospects.

Ultimately, successful execution of a digital banking project not only includes technology, but also mindset, culture. paradigm shift and, most importantly, a strong leadership vision

"Digital Banking is a confluence of channel segment, product, process and technology".

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View