Globally leveraging the US Credit Card experience and knowledge base

It would be fair to give Citi credit for coining the phrase Success Transfer. I first heard it around 1985, working for Citi in their Cards group in New York, where it was intended to take a successful model product, branch or business developed in one corner of the world, and replicate it across the globe. Thereby, transferring success.

In those days, Citi did enjoy the privilege of being one of the few banks that had a truly global consumer franchise, and was consequently uniquely positioned to execute against this very novel idea. Like most things in business the more they change, the more things remain the same. Citi's idea of transferring knowledge (success) within its own entity, two decades ago, is now still a very lucrative way for businesses to learn from their successes, or failures, of a product from a mature market and transfer that learning to a growth market in another country or even to another company.

Today, we sometimes loosely call this concept Knowledge Transfer. However, there is a clear distinction between Knowledge and Success Transfer, in that Success includes a transfer beyond just the know-how, and actually encompasses implementation. It may include, for instance, the operational or delivery platform as well. This is of particular importance with the global penetration of the Internet which allows for potentially globally leveraging a central operating platform.

Success Transfer may take various forms:

Success Transfer of a Brand

e.g., Global expansion of Online Auctions: eBay's success in the US led to the mushrooming of a variety of online auction sites across the globe. Typically, in each country one site took the lead in market share. This became an attractive target for a company like eBay with global designs. eBay chose an acquisition strategy to expand, and when they did acquire the local leader and overlaid their eBay brand, followed by their US operating model, these local sites got a lift to a whole new level. This was enabled by leveraging the Internet to globally offer unique capabilities such as seller rating and PayPal.

Success Transfer of Personnel

e.g., Investment Banking expansion into Asia: creating offices in-country, instead of managing projects from regional headquarters in Hong Kong, Singapore, or even Europe, and transferring staff native to that country to run these offices. Enabling both key personnel to run these local operations on a daily basis, while generating deal flow by leveraging the staff's local knowledge and connections.

Success transfer of a Base Model

e.g., Growth in Golf Courses across the world: The sport has grown in popularity across the globe primarily due to the rise of talented golfing professionals from far corners of the world. Following this rise in popularity, the demand for golf courses gained momentum, and the world looked to the top US designers for their state-of-the art well manicured courses abundant in the US as a very desirable design. The US designers executed their growth very effectively from country to country by sending small teams with a basic architectural blueprint of a course design with a menu listing of add-ons like the clubhouse, etc., to choose from. Obviously, adapting to local requirements and needs. Incidentally, this methodology required minimal involvement of the celebrity designer himself.

What drives Success Transfer?

Interestingly, historically it is not an aggressive strategy but almost a defensive one. That was because the local market was maturing and new opportunities needed to be found. The most obvious place for these new opportunities in most cases was the fast growing overseas market. Today, however, with the electronic shrinking of the globe it is reshaping itself as an aggressive strategy, with companies in growth countries inviting global talent to jump start or further accelerate their local business.

It eliminates the need to reinvent, and replaces it with an opportunity to adapt. In addition to adapting the operation itself, a successful transfer needs to accommodate local customs, needs and business practices. It allows a transfer of not just successes but also of why failures occurred. In other words, we are able to learn from our mistakes, not to repeat them. In a nutshell, we can hit the road running.

Why Cards Today?

There are two specific factors contributing to this opportunity:

Firstly, with the maturing of the US Card market resulting in several consolidations, a pool has been created of displaced highly talented and very experienced Card industry professionals. This pool has enormous knowledge of successful practices deployed within the US Card industry. The magnitude of the consolidation in the industry is reflected by the market share of just the top 3 issuers which increased dramatically from 40% in early 2000 to over 60% today, brought about by a series of acquisitions and mergers, typical of a maturing industry

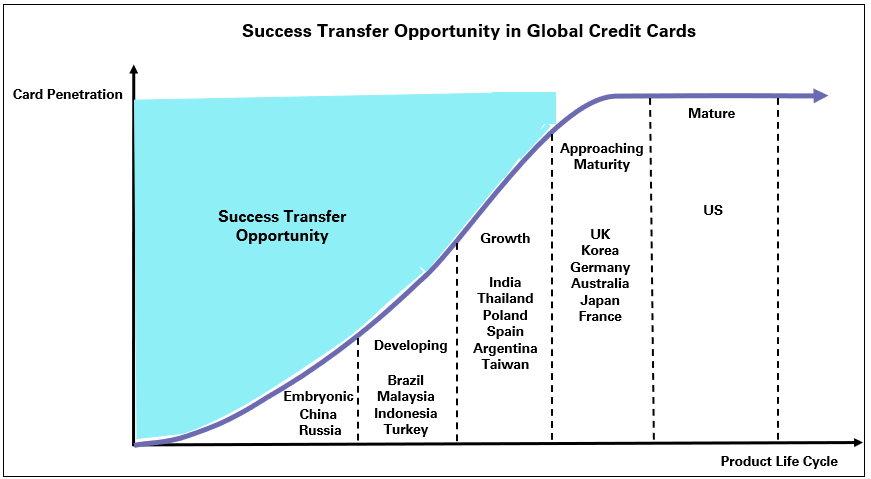

And secondly, the rest of the world is following fast in the footsteps traveled by the US in accepting the use of Cards, and Credit, as depicted below and is creating a Success Transfer opportunity of enormous proportions:

The potential size of this opportunity is huge and will come from a vast number of players: new entrants into the card business: international financial institutions that have, or desire to have, a cross-border consumer franchise, as well as existing global consumer businesses looking to make their operations more efficient, and lastly from Card monolines.

A simplified layout of the global potential is depicted below. As countries enter the Card business and move along the maturity curve, there are operational and conceptual practices that can be brought to these countries from more mature markets further along the curve. Clearly, the US is in the most advantageous position to enable Success Transfer.

In Cards, success will be enabled by several processes being brought out from the US market and adapted to local customs and needs. Some of these processes include:

- Acquisition Models: both marketing techniques and credit management

- Credit Scoring: building of databases and data monitoring techniques

- Operational Expertise: installing tested procedures and functionality

The Americanization of the globe (or how the world has come to love Credit)

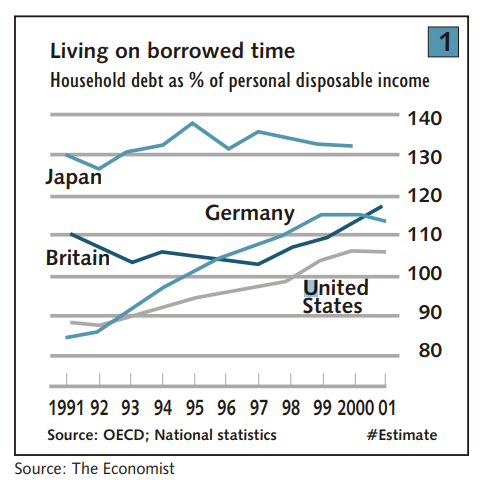

Whatever the motivation, credit is fast becoming the norm, almost in every corner of the world, after generations of belief of “neither a borrower nor a lender be” attitude. What is interesting is that trends in debt growth across the globe are now outstripping the US:

Specifically, the growth in Credit Cards has been spectacular. Interestingly, it is not just the credit feature that has made Credit Cards an attractive product globally; it is their phenomenal payment capability as well. And, for most, it is really the combination of these two features that makes this plastic a necessity

- Visa-branded cards are accepted at more than 20 million merchant locations in over 160 countries around the world

- MasterCard cardholders can use their cards at more than 23 million acceptance locations around the world in 210 countries and territories

This change in attitude of embracing Credit has also shadowed the spread of American business activities globally, be it via an Outsourced service or the inflow of an American business operation into the country.

The time compression of embracing Credit: the Outsourcing industry example

Though in limited pockets across the world, the Outsourcing phenomenon seems to have accelerated the cultural change of accepting credit. Here, in conjecture, is how it may have enabled such a change in India:

The Outsourcing industry was, perhaps, most impacted by the need for customer service reps to sound “American” while talking to their US customer. This cultural adjustment complemented by the unusual hours of operation in the local country in order to serve their customers on US time, gave rise to a new generation of hang-out spots for those employed in this industry to cater to their odd hours. This, along with the Internet, further promoted the spread of a new culture for these folks. This culture was dominated by American styles, dress, fast-food, music, movies, etc. Further, with the excess cash now available for these young professionals created the means to act on the new mindset promoting high spending patterns. Sensing the opportunity, in-country banks added a convenience factor to facilitate these new spending habits with an ideal instrument for exactly such a purpose: the credit card.

Though this path is more descriptive of what young folks are experiencing today in India, Cards were already booming prior to the onset of the Outsourcing segment. It just accelerated the growth.

Across the globe, the growth of cards keeps gaining momentum:

- Australia: Reserve Bank of Australia revealed statistic this year to show that the average debt among the 70 percent of households with a credit card reached A$5,162 in 2004, up from A$1,601 in 1996, an average annual growth rate in excess of 16% in each of the eight year span.

- UK: For a five-year span, from 1999 through 2004, total credit card borrowing grew 87 percent compared with a 54 percent increase for all other consumer loans during the same period.

- Taiwan: At year-end 2003, total credit card outstanding balances were NT$376.7 billion, 28% above 2002 and 41% over 2001, even when adjusted for inflation.

- S. Korea: Largely debt-free till as recently as 1997. Now, however, households carry an average balance of US$27,000 in debt. As of December 2003, the average South Korean consumer had four credit cards, and total debt on these credit cards was US$97 billion, significantly at 14 percent of GDP

- China: A recent survey of Chinese consumers between the ages of 25 and 34 found 35% hold one or more credit cards. According to MasterCard, China could see the number of credit cards in circulation rise from approximately 3 million today to as many as 75 million by 2010.

Growth in card usage across the globe now exceeds that in the US, and perhaps will continue to do so, particularly in Asia, Eastern Europe, The Middle East and Latin America, as depicted below:

In conclusion

While Success Transfer may apply to replicating any well executed model from one business to a new geography, product or industry, in this paper it has been used specifically to highlight a clear opportunity that exists in transferring the successes of the experience from the US Credit Card industry, which has generated billions of dollars in annual profits for financial institutions, to the rest of the world. The circumstances that create this unique window of opportunity are specifically:

- The availability of talent with extensive experience of Credit Card management resulting from the consolidation in the US industry, and

The social and cultural change across the globe resulting in the world-wide consumer acceptance of Credit. Said differently, from the unwitting Success Transfer of a credit culture itself.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View