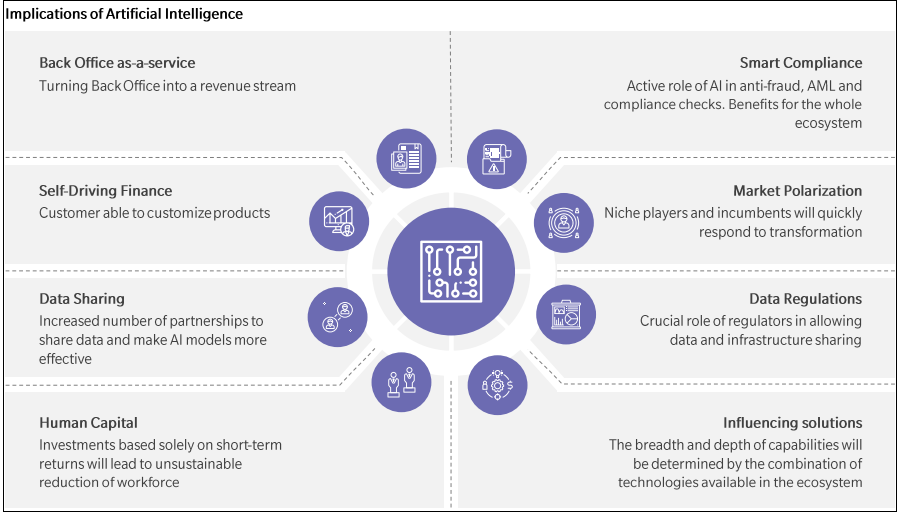

How the increased use of AI will change the shape and structure of financial institutions and the competitive nature of financial markets.

In defining Artificial Intelligence (Al), it has become quite common not to refer to specific technical approaches but rather to innovative capabilities that enable new ways of running the business. Such capabilities are typically a combination of technologies supported by predictive power and autonomous learning, which increasingly lead machines to improve the quality of their outputs. They include the ability to check data consistency, generate decision-making rules from general data, forecast future events and interact with users digitally or analogically.

The application of AI to financial institutions should be understood within the ecosystem of technologies that are meaningful for the business to operate. Emerging technologies are able to influence one another. For example, Blockchain could be critical in KYC and any identity-management operations, as it is a source of immutable data which doesn’t require centralised verification.

Quantum computing can contribute to make Blockchain even more secure as it holds the potential of discovering many encryption methods, and it can allow AI to solve problems which could not be addressed before. In turn, AI can enable the execution of more complex and automated smart contracts certified with Blockchain. Eventually, cloud computing can provide processing power and data storage to train the new AI model.

Front and back office operations will change

In the back office, the transition is likely to happen from a traditional model into a back-office-as-a-service model (BOaaS), switching from cost centre to profit centre. More specifically, in a traditional model only certain processes will be driven by AI, while others will lag behind, mainly because it is challenging to achieve excellence across all processes.

In BOaaS, institutions develop AI-driven centres of excellence around a set of processes and offer them as a service, to other institutions. This not only creates a competitive advantage for the institution (as processes continuously improve by learning from the data provided by their users), but it ultimately transforms back-office into a source of revenues. BlackRock’s Aladdin and Ping An’s OneConnect are two examples of incumbents that have created revenue streams from their services. OneConnect, Ping An’s technology infrastructure covering everything from advanced AI to core banking, has been adopted by more than 500 banks in China.

The value of AI will become apparent in reimagining the customer experience, where the customers’ finances run themselves and the financial institution acts as a trusted adviser when needed. Today, much financial advice is delivered impersonally and is based on limited customer information. Tomorrow, financial advice will be self-driven as the consumer will interact with agents to customise products, which will ultimately be provided by financial institutions.

AI will enable the transformation of the delivery model of financial advice in three ways:

- by comparing products and providers,

- by advising on bespoke products based on customer data

- by optimising routine customer decisions (e.g., optimising cash flows by avoiding fees, getting better savings rates and deals, switching providers if needed).

There are several solutions already available on the market for self-driving finance by both incumbents and FinTechs, for example Clarity Money and MoneyLion offer mass advice and customisation to improve the customer’s financial positions (e.g., consolidation of credit card debt, refinancing a loan or cancelling recurring payments). The same applies for corporate clients. Citi, for example, has launched a new app to allow customers to link their accounts across providers and provide a holistic view of their financial lives.

AI will also play a decisive role in fraud prevention and anti-moneylaundering controls. To date, those processes are inefficient as they are not based on collaborative AI-driven tools, hence the suboptimal process at one institution has a knock-on effect across the ecosystem. The result is a system-wide threat. What AI can do on this front, leveraging shared datasets is impressive, as it is able to recognise patterns and develop insights on threats that cross institutional boundaries, eventually allowing timely defensive response. Among examples in the market, SWIFT has launched a new AI solution for fraud control which blocks sent payments based on real-time monitoring and learns over time; and ComplyAdvantage has achieved 84% decrease in false-positive alerts for AML risk data, using AI-based algorithms to monitor transactions.

AI is going to reshape the market

AI-based platforms are expected to push customers towards lower-cost products even more aggressively. Offerings will be built and scaled much more efficiently as back-offices will be established based on AI services. Scale-based players will naturally have a cost advantage, capturing customers from mid-sized players. Niche players can capture under-served customers by optimising their offerings to the decision making of AI and targeting unmet and unique needs. The likely scenario will be a situation where mid-sized firms will struggle to make the necessary investment in AI to remain competitive, while incumbent firms will increasingly become AI service providers. This will result in a polarisation of market players at the expense of mid-sized firms, with a proliferation of agile and niche companies.

There is evidence that 48% of banks with more than $50 billion in assets have deployed an AI solution, against 7% for banks with between $1- $10 billion in assets, suggesting limited internal capacity among the latter to invest in innovation and respond quickly to transformation.

AI is hungry for data, to allow for accurate modelling. Short-term opportunities will require financial institutions to join partnership ecosystems and share their data. However, partnerships present risks with the potential of creating winners and losers. The winners will be those institutions that own the customer experience and have market power, pitting providers against each other. Cybersecurity will be a major risk as partnerships entail increased data connectivity which in turn exposes institutions to privacy issues and potential data security breaches. Finally, the reliance on data flows from partnerships may lock institutions into unfavourable relationships.

New niche providers have emerged since the UK Open Banking Standard and PSD2 came into force. N26 and third-party providers like Squirrel and Klarna are expanding in Europe. They extract from incumbents the data they need to feed their operations without giving incumbents reciprocal access, overcoming incumbents’ advantage of data exclusivity.

Data regulators will play a key role

The development of AI applications is heavily dependent on the cloud, hence the ability to access public and private cloud infrastructure and use stored data become of paramount importance. Those regions offering less regulatory restrictions offer advantages to technology players in developing new capabilities. Moreover, privacy and data protection regulations (e.g. GDPR) pose limitations and requirements on the way personal data is collected, stored and transmitted.

Regulations on data portability will affect the competitive dynamics. For example, following the introduction of Open Banking regulations, incumbent institutions in Europe are required to share customers’ financial data with third parties upon customer request.

This will allow technology firms to access financial data and use it together with personal data, which puts them in a favourable position to start developing new AI-driven applications for clients’ finances. Financial institutions do not have the reciprocal ability to access non-financial data from third parties.

In conclusion, while the adoption of omnichannel started across the banking industry at multiple speeds and at different timings due to market and regulatory differences, global players are expected to be converging to the same track in this fascinating digital transformation journey

Lastly, the rapid advancement of technologies must encompass the development of a talent ecosystem. While short-term optimisations typically drive value through headcount reduction, a situation in which talents erode faster than new opportunities are created is a likely scenario if the financial institution doesn’t have a clear vision. In that case, this risk creates a roadblock for a transformation agenda going forward due to lack of talents at hand.

Tomorrow’s business environment will be based on new talent strategies and capabilities, in terms of role, culture and reward schemes. If financial institutions do not evolve their talent strategies along with business transformation, they run the risk of creating hard-to-fill gaps in their talent profile.

To conclude, institutions need to balance their strategy between collaboration and competition. Financial Institutions should strive to be first AI adopters, as that will allow them to establish a competitive advantage. At the same time, collaboration with multiple stakeholders is critical, as AI requires an extensive network of partnerships and collective efforts by financial institutions which can be achieved only in supportive regulatory environments.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View