Digital payments is a revolution that we are all a part of – ‘pay attention’, pun intended, and one can see churn is in the making

When a regular street vendor in India advises you not to search your pockets for that small change and instead suggests you pay through the QR code proudly displayed, one can tell the real proof of the pudding is there, and it’s ready to eat. No, we are not talking about sophisticated retailers here, nor is it a swanky 5-star environment. This is about a typical small vendor, selling goods in a small street on a little cart with the value of the transaction being as low as INR 10 (which is roughly US 15¢). So, what’s the big deal, then? As they say, it is the bottom of the pyramid where the real gold is hidden. Let’s figure out how.

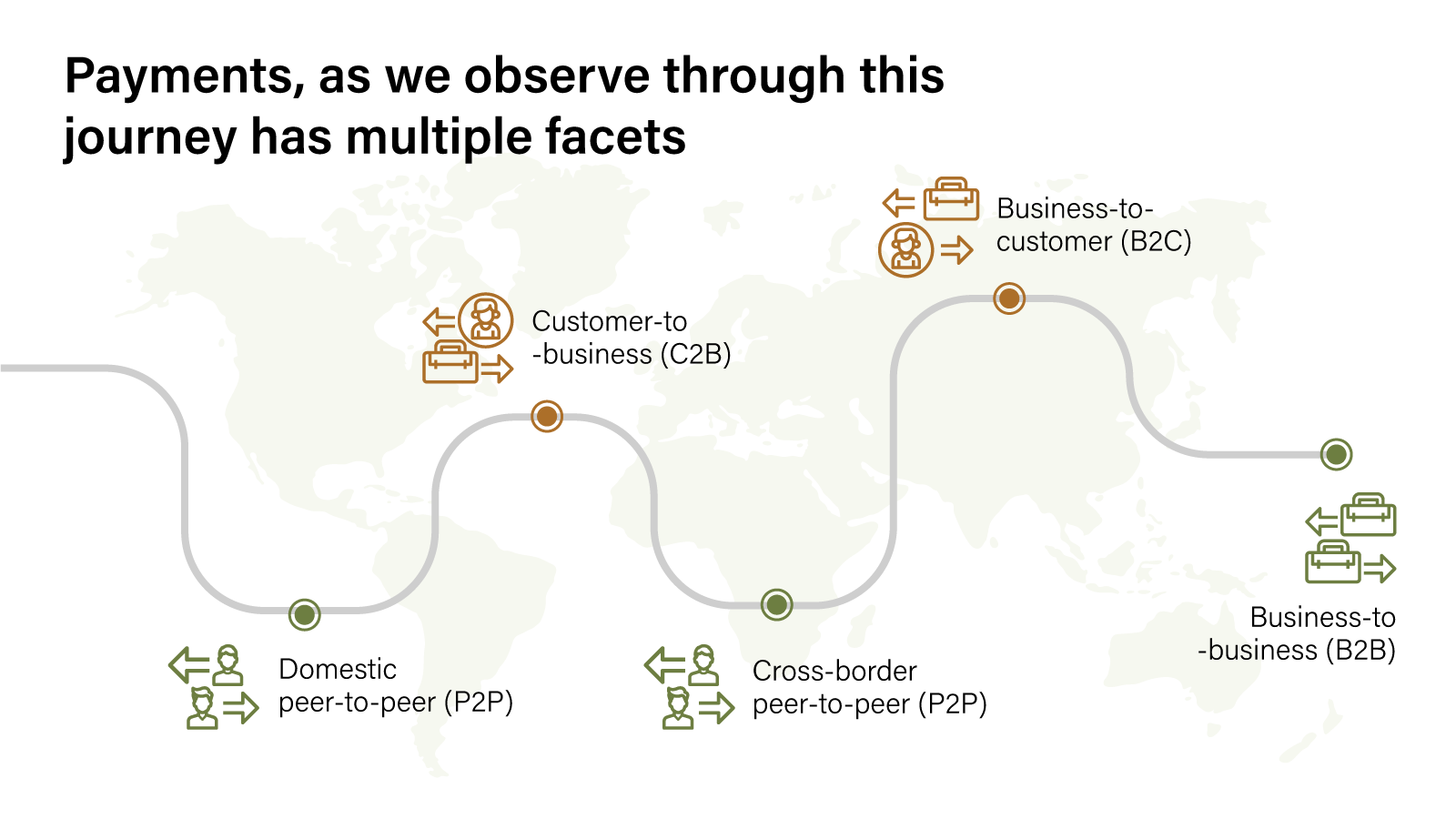

Payments, as we observe through this journey have multiple facets:

- Domestic peer-to-peer (P2P)

- Cross-border peer-to-peer (P2P)

- Customer to business (C2B)

- Business to customer (B2C)

- Business to business (B2B)

While BigTech expansion and heavy-duty funds transfer with cross-border payments and transaction banking are obvious candidates for technology-driven transformation, it is the smaller value payments tickets that seem to have made this change count, for the common man. Quite obviously, although B2B payments tend to be higher in value, it is the P2P models that hold the key to large transaction volumes even if they are much lower in individual transactional value.

It is interesting to note that the Unified Payments Interface (UPI) of India crossed the $1-trillion mark in transaction values in March 2022. And herein lies the secret sauce. When a government has laid out the backbone of a payment interface, what you get to see as the proliferation of use-cases, is mind blowing. For instance, when the P2P model of payments is also being extended to make the payment to a merchant by the customer without any deduction of fees, it enables the street vendor (remember the seller we spoke about earlier?) to happily promote QR-code enabled digital payment and thereby enjoy the two things that matter: increased footfall and immediacy of funds. And when this model of digitally enabled payments becomes mainstream, it becomes the fountainhead of the ‘new oil’, aka data.

The one thing that most experts who spoke at the IBSi Payments & Lending Conference earlier this year in Mumbai agreed upon, was this: being in the digital payment space is the ‘cost of acquisition’, and the name of the real game sitting on the back of it is the digital lending business! Sounds fascinating? It very much does. Considering that the size of the untapped low-value-working-capital lending market in India alone is tipped to be anywhere between $500 billion to $1 trillion, the potential that many of the digital payment players are building is measured not just by their transaction volumes, but more by the veracity of the data that is generated therein. Every digital transaction also has the stamp of the buyer and the seller, the product that is transacted, the value and, on a collective basis, also reflects patterns of cashflows, seasonality, preferences and all the ingredients to help AI engines build those predictive analytics.

Adding more spice to this digital payments’ bandwagon are the non-financial services including e-commerce, utilities and insurance and the related payments which provide deeper perspectives on the customer. The booming of several new-age PayTechs with single-stop payment services is also an effective barometer of the times we are living in. No wonder then, that digital payments is at the top of the list when it comes to private equity (PE) investments.

The other interesting area of immense focus is Buy-Now-Pay-Later (BNPL). Is this indeed a new phenomenon or simply old-style credit extended by one’s local grocer being repackaged in a new avatar? Is BNPL truly a payment product or is it a lending product? While the debate on these questions continues to rage in many conference floors, the larger point that is of importance in the current context is intelligent analytics. The power of an alternative data engine has enabled instant credit decisioning laced with innovations that can help drive retail consumer spend – the foundations for which, as we saw earlier may be laid by the wealth of data driven by digital payments. Some 4% of all UK retail spend is reportedly on BNPL, which is telling.

We see the above not only as a reflection of the Indian context (which has taken the lead on the digital payments space), but pretty much a global phenomenon in the making. While payments may be going through a significant ‘digital churn’, what does all of this mean for us in the near to medium-term future? Here are 5 predictions that experts have to offer, that we should all be witnessing in the not-so-distant future:

- A plethora of innovative products: Abundance of data and AI-enabled instant credit implies a lot of new players and the need for differentiation. Products, driven by innovation, will hold the key. BNPL is a case in point. A higher number of new and innovative FinTech-enabled products will gain currency globally. Contactless payments using QR codes and cards are increasingly commonplace. An API-enabled ecosystem will help banks to make several FinTech offerings main-stream.

- Consolidation & Collaboration: Even as multiple players get to offer multiple products, having an offering for the life-value of the customer and being present through the journey may imply the need for collaboration. We already see ‘super-apps” that have multi-purpose usages (e.g. ticket booking, banking, etc.) emerging. Too many players in the industry would lead to natural consolidation.

- Data Security: BigTechs such as Google and Amazon are leveraging existing infrastructure to improve real-time payments, which not only brings in convenience but also the need for extra caution. Cyber-threats will become a larger challenge than ever before and will continue to be an area for increased vigilance and related investments. Cyber-risk and cybersecurity will become much more integral to banking models

- Payments & PE Investments: Digital payments will remain a most sought-after sector for PE funds and investors, as it lays the foundation of FinTech-enabled digital lending. The performance of such new-age lending books and their asset quality to be an area for us to watch.

- Regulations: With digital payments, real time payments and AI-enabled payments becoming more ubiquitous and cross-border, regulations are also likely to evolve to be more broad-based and inclusive. This will be even more critical for B2B payments, enabled by payment gateways.

As one of the panelists at the conference famously quipped, digital payments is not just about cashless, but also about less-cash, as we move forward. And that means fewer ATMs too. Money, as we have known over the generations, may therefore look and feel different in the years to come. It’s time to wake up and smell the coffee!

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View