Islamic FinTech refers to the branch of financial technology adhering to Sharia principles. Despite its roots in Islamic finance, it is gaining traction among non-Muslims due to its ethical framework, mirroring the broader appeal of the Islamic finance sector.

‘FinTech’ is a merger of the terms ‘finance’ and ‘technology’ and refers to businesses that use technology to enhance, automate, and improve financial services processes and propositions. Islamic FinTech is, hence, a type of technology that is ethical, religiously acceptable, and embracing environmental, social, and corporate governance (ESG) elements.

Both ESG and Islamic Finance have similar ideologies; there may be little to separate an ESG-compliant FinTech and an Islamic FinTech; however, Islamic FinTech can also be understood to have an additional faith-related label that can be appealing to the Islamic population/ regions around the world.

Here's how Islamic FinTech incorporates each aspect of ESG:- Environmental (E): Islamic FinTech companies focus on environmentally friendly practices by avoiding prohibited industries. Additionally, Islamic finance encourages investments in sectors that promote sustainability, such as renewable energy and clean technology.

- Social (S): Islamic FinTech prioritizes social responsibility by promoting financial inclusion and equity. It offers Sharia-compliant financial products and services that cater to the needs of underserved communities, ensuring fair and ethical treatment for all stakeholders. Moreover, Islamic finance prohibits transactions involving exploitative practices, such as interest (riba) and excessive uncertainty (gharar), thereby fostering fair and transparent business dealings.

- Governance (G): Islamic FinTech companies emphasize strong governance practices to ensure transparency, accountability, and ethical decision-making. Sharia principles dictate that financial transactions must adhere to specific guidelines outlined in Islamic law, promoting sound governance practices and risk management. Additionally, Islamic financial institutions often establish Sharia supervisory boards to oversee compliance with Islamic principles, enhancing governance structures within the industry.

It includes Wahed, the Islamic online wealth manager, and the UK’s Niyah and Germany’s Insha – which are Islamic banks focused on mobile banking. Some of the more innovative and recent Islamic FinTechs include Malaysia-based HelloGold, which is working on the world’s first Sharia-compliant gold mobile application.

Elsewhere, IslamiChain, which took part in the DIFC FinTech Hive’s 2019 FinTech Accelerator Programme, is looking to create transparent and accountable delivery mechanisms for philanthropy and compassionate giving, using blockchain technology and decentralised digital identity.

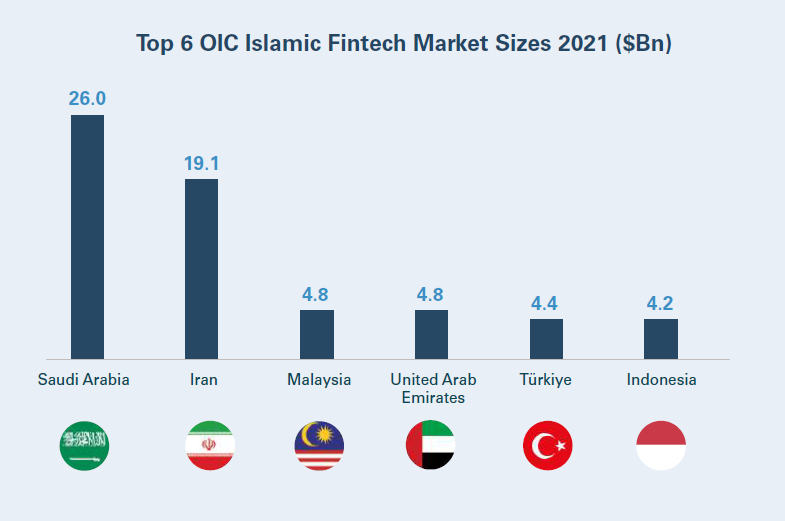

Source: Global Islamic FinTech Report 2022

Hakbah claims to be the 'first cooperative saving platform' in Saudi Arabia. It also graduated from the DIFC Fintech Accelerator Programme 2019. It has a strategic partnership agreement with Visa, operates through SAMA's Sandbox, and, in January 2021, raised $1.2 million in seed funding.

Saudi-based Wethaq has been working since 2018 to bring 'FinTech innovation' to the Islamic capital market, developing a platform focused on structuring and distributing Sukuk (Islamic bonds).

The Global Islamic Fintech Report stated that Saudi Arabia, Iran, United Arab Emirates, Malaysia, and Indonesia are the leading countries in Islamic FinTech transaction volumes within the Organisation of Islamic Cooperation (OIC) countries.

The Islamic Fintech market size is anticipated to reach $179 billion by 2026 at a CAGR of 17.9% compared to the global Fintech industry, which is expected to develop at a CAGR of 13.5% over the same period. The top 6 OIC Fintech markets by transaction volume for Islamic Fintech are Saudi Arabia, Iran, Malaysia, UAE, Türkiye, and Indonesia. The Top 6 markets account for 81% of tvhe OIC Islamic Fintech market size, indicating two dominant regional centers emerging amongst OIC countries for Islamic Fintech.

The key areas for Islamic FinTech

The Islamic FinTech landscape is still in its early stages. Over 75% of Islamic FinTechs are active in more traditional areas related to raising funds, deposits and lending, wealth management, payments and alternative finance. However, the digital banking space is gaining increased importance due to the launch of neobanks/digital-only banks.

Social finance is considered a significant opportunity area for Islamic FinTech. This means potentially tapping into the multibillion-dollar Islamic social finance pool that comprises Zakat (obligatory charity), Sadaqah (voluntary charity) and Waqf (endowments). This itself has the potential to contribute anywhere upwards of $200 billion towards social programmes and projects internationally.

Several key countries have recently introduced regulatory initiatives in Islamic FinTech that will help provide impetus to the growth of their national Islamic FinTech sector. For example, Saudi Arabia has onboarded another 9 FinTechs into its regulatory sandbox, a sure sign of the swift pace it is moving at to grow Saudi Islamic FinTech. Meanwhile, Egypt’s Financial Regulatory Authority (FRA) has seen its legislative framework take a step closer with parliamentary committee approval in October of a draft law regulating FinTech in non-banking financial activities. The law also includes provision for the establishment of a ‘lab’ to test new FinTech products. Being a significant market for Islamic FinTech, the codification of this framework should spur growth in Egypt amid increasing public interest in Islamic finance solutions.

Financial inclusion matters

The World Bank’s report 'The Global Findex Database' stated that globally there are almost 1.7 billion unbanked people who can be potential customers for retail banking and more than 200 million micro, small and medium-sized businesses that required banking assistance. This presents an enticing business opportunity for Islamic FinTechs, as the report also pointed out that the unbanked population is dominated by Muslim-populated countries/ regions that comprise almost 50% of the world’s unbanked population. While much of this population is spread across poorer regions of Sub-Saharan Africa and Asia, recent gains by telecom and mobile networks across these regions should help FinTechs tap into populations in economically remote areas.

FinTechs strive to provide cost-effective solutions for companies looking to reduce overall costs, improve customer experience and automate business processes. The financial services industry is a critical sector in every society and hence is one sector that is heavily regulated. The introduction of FinTechs, including Islamic FinTechs, especially in developing countries can help boost economic growth but this also increases the scope for the local regulators. They need to understand the FinTech implications and take steps towards ensuring the stability of the financial system and protect it from new-age issues related to cyber-attacks, data leakages, data thefts, etc.

At present, there is no globally accepted regulatory body for Islamic FinTech. In common with the regulation of conventional financial services, the regulation of Islamic financial institutions and Islamic FinTechs, is carried out in each country individually. Examples of local regulators include Bank Negara Malaysia and Securities Commission (Malaysia), Financial Services Authority (Indonesia), SAMA – the Saudi Central Bank, as well as their counterparts in Western markets, such as the Financial Conduct Authority (FCA) in the UK, which regulate Islamic Fintechs within their overall existing framework.

However, standards promulgated by AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) are followed in 20+ Muslim-majority countries/jurisdictions. We may reasonably expect that these standards, including those relating to Islamic FinTech segments, will continue to gain acceptance with local regulators looking for consistency and acceptability of standards internationally.

With a global focus on alternate investments and ESG, Islamic FinTechs have the necessary framework and impetus to improve the sector’s global footprint and market share. As far as the immediate future is concerned, Muslim countries and regions should remain a priority as acceptability and education barriers are low. However, in the end it is the innovation, offering and customer benefit which will eventually make the Islamic FinTech successful along with the right environment – both in financial regulatory and Sharia terms to ensure they have the necessary oversight and direction needed for continued sustenance and growth.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View