From the Past

Bill Gates famously said in the 1990s that “Banking is necessary, banks are not”. Given the developments in the Banking industry in the last few years alone, his statement seems very perceptive. With challenger banks across the globe redefining what it means to be a bank, traditional banks that are unable to keep pace with the disruptions are facing their moment of reckoning. Perhaps a similar reckoning is required in the Insurance industry. Few industries conjure up the visual of the word ‘Traditional’ as completely as the Insurance industry does. Since its inception over 3 centuries ago, the Insurance industry has proceeded along at a stately pace, treating innovation with the kind of suspicion it reserves for fraudulent claims.

Changes are afoot though. The industry has had to deal with digital disrupters, a shift in consumer expectations, and the challenge of improving insurance penetration efficiently. While most insurance carriers will continue to perform the same basic processes for the foreseeable future, the way these processes are executed is likely to undergo change. Smarter use of data and technology is likely to drive efficiency and improve customer experience. In this article I look at 4 key innovation trends that are likely to drive the Insurance industry in the future.

1. Firing up the Online Channel

While traditional channels such as broker networks, branches and Banca will continue to be important distribution channels, insurance companies and brokers will have to strengthen their digital led distribution efforts to achieve the next level of growth.

With global insurance penetration hovering around the 6-7% mark, and emerging markets generally around 4%, the potential to grow is unquestionable. A brick and mortar, or feet on street approach will have its limitations in expanding reach in an efficient manner. This becomes even more important in geographically vast emerging markets such as India, China and Brazil that are expected to drive global growth in the industry.

As a larger proportion of the population across the world gets access to internet, the comfort with conducting financial transactions has increased greatly. Coupled with a growing digital native customer base, the incentive for insurance companies and brokers to have a strong online offering is apparent. Having an online portal that generates an instant quote and allows for customers to purchase the policy immediately is fast becoming a hygiene factor across the industry.

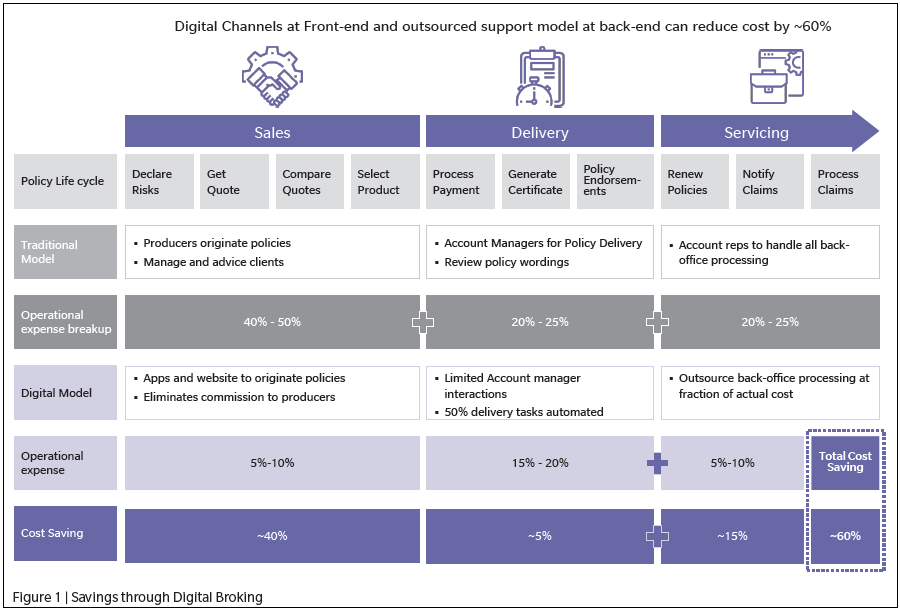

Customers now expect their online experience with their financial service provider to match their experience on e-commerce or social media websites. Although the online channel typically accounts for 10-20% of business currently, this is likely to see a major push to arrive at the next level of growth. Similarly, brokers leveraging digital channels at the front-end & outsourced support model at the back-end can reduce costs by ~60% (Figure 1)

2. (Artificial) Intelligent use of Data

Since The Economist published a report titled “The world’s most valuable resource is no longer oil, but data” in 2017, ‘Data is the new Oil’ started trending. I would say that data is now the new oil, dipped in gold and sprinkled with diamonds! The ability to capture, analyze, and draw conclusions from data is now the source of competitive advantage across industries. The next wave of insurance growth will be driven by smarter data management to enable real time decision making. Customers are already generating large volumes of data. Insurance companies need to leverage data analytics and Artificial Intelligence (AI) to make smarter and efficient decisions across functions. From claims management to risk assessment, and marketing to customer pricing, intelligent use of data is a growth imperative.

While most large players already leverage data in some shape or form, they will need to upgrade the way they collect and analyze data to truly embrace the power of AI. The two key areas that AI is already revolutionizing is in faster claims settlements and reduced fraud. Insurance companies, large and small, have already started using AI for vehicle collision estimates. The driver involved in the accident simply uses their smartphone camera, and the AI enabled app estimates damages based on AI photo analytics to come up with quick damage estimates. This in turn reduces the settlement timelines and improves accuracy, improving customer experience and safeguarding insurance companies.

Case Study: Lemonade Insurance Company

When life gives you lemons, make a USD 2bn valued insurance startup. Lemonade Insurance Company, founded in 2015, is a licensed insurance company that is a millennial-friendly web platform providing discounted homeowners and renter’s insurance. It has over 425k customers, with 75% of them under the age of 35, and a valuation of over USD 2 billion. Lemonade is driven by strong Technology (Artificial Intelligence) and sound Behavioural Economics. The AI driven bots have replaced brokerage networks, reducing claims processing times to minutes. What truly sets the company apart is its use of Behavioural Economics to improve transparency and build an unconflicted business model. Lemonade takes a flat fee (25% of insurance premium revenue) for administrative costs and potential profits, using the rest of the money to pay claims. Whatever money is left is given to a charity selected by the policyholder. In this way Lemonade succeeds in creating a social contract between all parties and discourages fraudulent claims.

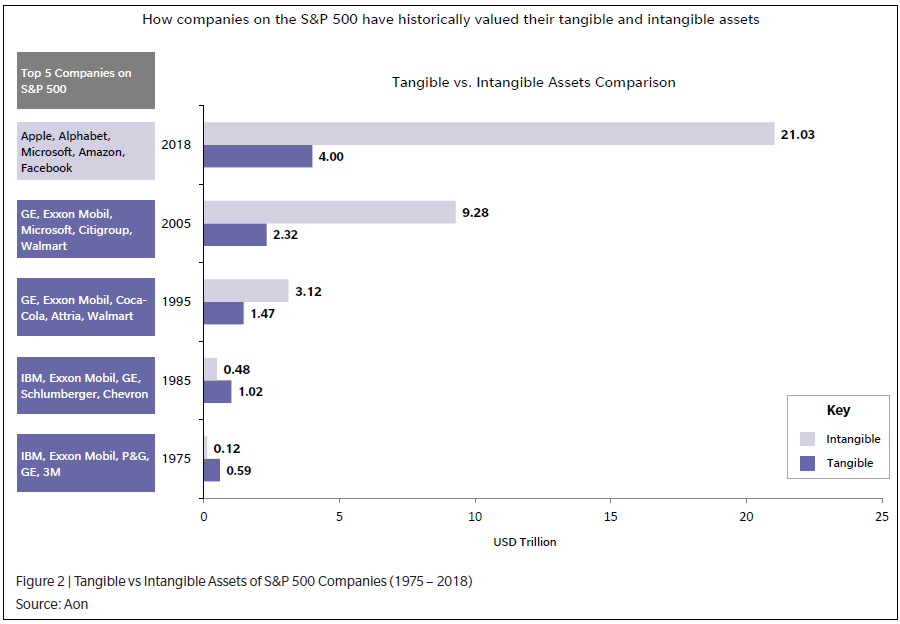

3. Understanding and Insuring the New Economy

The global economy has evolved rapidly. While the last century gave us manufacturing behemoths, the titans of this century are not producing physical goods in factories. According to Statista, the Sharing Economy (‘on-demand economy’ or ‘gig economy’) is likely to reach USD 335 billion in 2025. For large commercial insurers used to servicing the Automobile manufacturers, grasping the opportunities with the likes of Uber is a different challenge. According to a study by Aon, Intangible Assets accounted for over 80% of the value of S&P 500 companies in 2018, up from just 17% in 1975 (Figure 2). New products and expertise will be required to cater to the needs of this new economy.

This has led to the rise of companies such as Y-Risk, an underwriting company of The Hartford, that focuses on tech-enabled companies in the Sharing Economy. They also provide customized insurance solutions that help companies with cyber risk management that includes data breach, cyber extortion and ransomware. Another organization focusing on start-ups and high growth companies is Founder Shield, a New York based Insurance Broker who offers customizable insurance packages based on the funding raised by the start-up. It provides coverage across new age industries such as e-commerce, cleantech, e-scooters, and even cannabis! The established insurance players will need to realign their understanding of what constitutes a potential client and customize their offerings to cater to those needs.

4. Capturing the Internet of Things

The Internet of Things revolution involves everyday devices that are fitted with sensors and broadcast real time data – this can be in the form of wearable technology, home assistants, and connected vehicles. Each of these segments is going to see rapid growth in the future. According to the Economic Times, the Wearable Technology market is likely to reach USD 54 billion in 2023, from USD 23 billion in 2018. Some of the largest auto manufacturers are already in the race to perfect the driverless vehicle, which is going to make connected vehicles de rigueur in the future.

Internet of Things (IoT) driven Insurance presents an opportunity for the industry to move towards a ‘pay what you risk’ model. It represents a new paradigm for insurers and allows them tap into relevant data to move analysis from proxy to real data and personalize pricing for each customer. In this way, safer drivers can be charged lower premiums for auto insurance, while people with a healthier lifestyle can pay less for health insurance.

This provides insurance companies with the opportunity to generate additional revenues through better pricing and customer experience, and curb costs through active prevention and reduced frauds.

Into the Future

The year 2020 has given us the concept of ‘social distancing’. Insurance companies would do well to capture the zeitgeist, and fast track the drive towards a digital-led ‘no touch’ operation. While having an attractive digital front end is important, intelligent use of data and automation will be crucial to run efficient operations and deliver an outstanding customer experience in this new world order.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View