The Real-Estate sector has undergone significant shifts in the last decade and remains essential to the country’s economic and social progress. In addition to classical supply-demand levers, this sector will most likely see significant transformational changes due to technology, changing lifestyle needs and sustainability.

Context

The Real-Estate (RE) sector is a multi-asset mix of residential, office, industrial, retail, and hospitality. Across the globe, the RE sector’s growth has been shaped by the country’s GDP forecast, demographic needs, the strength of credit markets, and regulations & trade policies. Each asset class offers a unique return-risk profile and has followed distinct paths after the pandemic. For example, pre-pandemic, the occupancy levels in offices were in the north of 70% of developed markets, while post-pandemic, the occupancy levels have come down to 40-50% compared to 80-95% in Asia and the Middle East. On the other hand, with the CAGR of +10% in global e-commerce (2023-27), demand for warehouses and data centres has increased multi-fold. In residential space, customers now demand bigger and better spaces to provide for mental health & wellness, remote working capabilities, and other lifestyle choices.

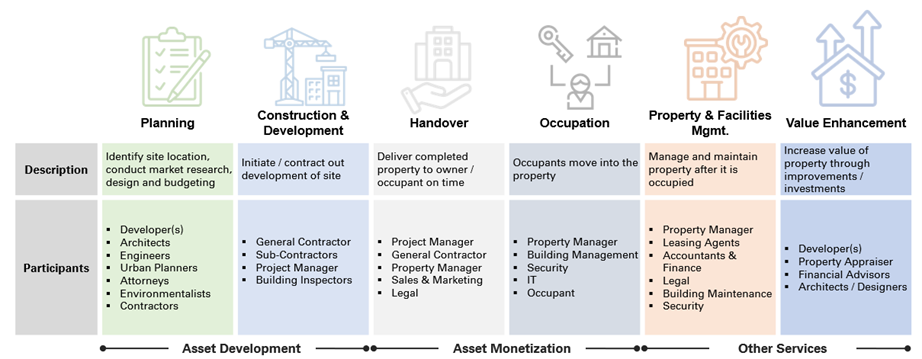

Invariably across sub-categories, the RE life cycle remains standardized, from planning to delivering value-added services.

The RE Lifecycle is broken down into 6 stages:

- Planning

- Construction & Development

- Handover

- Occupation

- Property & Facilities Management

- Value Enhancement

The initial planning, design and construction stages involve multiple participants and are focused on asset development. The later stages are focused on asset monetization and value-added services.

Technology, Sustainability, Urbanization, Aging Population, Emerging Local Supply Chains, and Remote Working are some of the global trends shaping the RE sector. Each stage in the RE lifecycle has its own challenges and opportunities for developers, property management (PM) and facilities management (FM) firms.

Challenges

Post-pandemic, RE has seen varying patterns across the globe. In developed markets, undersupply of new housing, significant inflation in construction costs and less than optimal return to offices have created headwinds for the RE sector, making it expensive for people to buy or lease. On the other hand, in the Middle East, RE sector growth has been spurred by government policies and support on immigration, tourism, modernization, land bank availability, and infrastructure. Despite an increase in $/sq.-ft across various asset classes in the Middle East, growth remains robust in 2023 and beyond.

However, there are still challenges across asset development, monetization, and other services.

- Fragmented Ecosystem: The asset development phase consists of multiple participants engaging with each other at different times. This poses challenges in standardizing project specifications, prioritizing must-haves over nice-to-have features, maintaining budget compliance, and completing on time. Lack of clarity on the governance model, performance management of participants and rules of implementation lead to duplication of work, non-compliance, and delays.

- Material, Labour, Re-work & Regulatory Costs: RE is a capital-intensive industry. Material, labour, re-work and regulations are the key cost drivers in the development phase. Developers, architects, and planners end up spending significant effort in re-designing master plans and finalizing requirements with the contractors. In addition, loosely defined procurement strategy and implementation lead to value leakage in material, labour, supplier margins and regulatory compliance costs.

- Land Bank Availability: The availability of high-quality land and free-zone subsidies are common features in developing markets / emerging economies. The supply of high-quality land and pricing impedes RE growth in many developed markets.

- Obsolescence: RE stock that is outdated or not in line with market expectations is termed obsolescent. Sometimes as the RE sector is growing due to high demand, developers tend to oversupply the market with less differentiated stock or less suitable for evolving future needs of customers in wellness, health, lifestyle, and sustainability. Thus, it may lead to lesser occupancy, lower cash flows and lower valuation, which erodes the equity of the developer/owners.

- Under-digitization: The RE sector has traditionally been slow to adopt technology. Across the RE lifecycle, processes are burdensome, less automated and involve multiple touch points with the participants. Secondly, the perception of RE has been an asset-driven sector with more focus on occupancy and sq.-ft and less on REaaS (Real-Estate as a Service) by leveraging data and artificial learning to unlock new revenue opportunities. The traditional focus has remained on the design-to-build / sell instead of design-for-experience for end customers.

Way Forward

Despite all the challenges, RE has excellent potential to innovate, fostering mobility and driving sustainability.

- Top-Down Focus:Embedding customer experience needs, innovation, and sustainability is essential for a developer, PM, and FM firm. The top-down sponsorship and messaging are vital in establishing a robust operating model and driving benefits across the RE lifecycle.

- Strengthen Procurement: Procurement plays a very significant role in the RE sector accounting for 50-80% of the total spending in a centralized set-up and 20-40% in a decentralized set-up. Therefore, it is vital for firms to have a centralized procurement function for material goods and services in sourcing sustainable materials, promoting steel de-carbonization, reducing GHG (Greenhouse gas) emissions, including scope 3, driving savings and mitigating supplier risk.

- Move towards Design-for-Experience: Traditionally, RE had been built on the principle of design-to-build/sell by conducting feasibility studies, developing master plans, and building prototypes (albeit expensive) to lease or sell to the occupant eventually. This approach is moving towards designing for customer needs. For example, some of the developers in the Middle East have started exploring design labs inviting ideas from artists, academicians, environmentalists, and scientists and conducting lifestyle/mobility studies of demographics. PM and FM must be integrated as strategic components in delivering a holistic customer experience. Beyond basic property and hard and soft facilities services, customers are demanding lifestyle choices in the form of childcare, medical, café, phone charging, electric charging stations for cars, wellness centres, co-working space, on-demand cleaning services, remote identity & access, events, etc. Particularly post-pandemic, RE services have become the key competitive differentiator for the firms in attracting customers and higher valuations.

- Innovation RE is ripe for disruption to unlock value for all participants through RE-as-a-Service (REaaS). Key areas for innovation are:

- Process Re-design & Automation across the RE lifecycle offer material savings and efficiency gains. For example, updating the master plan remotely, selecting and ordering a material catalogue, building a prototype of a building in the form of a digital twin, document management, e-Signatures, virtual tours, digitizing sales and handover process, ordering on-demand building services, robotic cleaning, etc.

- Data Analytics, AI & IoT offer opportunities to reduce costs and unlock new revenue opportunities for firms. For example, developers deploy digital twins in a virtual environment to analyze various scenarios and reduce re-work costs. Developers / PM / FM firms can deploy super apps for occupants to drive on-demand identity and access, utility, and 3rd party services, assess occupants’ data usage history, recommend customized services, and earn revenue through merchandise partnerships & promotions.

- Business Innovation around the globe is happening in the form of fractional ownership of residential assets, firms offering flexible duration independent subscription-based leases inclusive of all services, flexible financing solutions and payment plans.

There’s tremendous potential for the RE sector to disrupt itself and add more value for its participants and other sectors. Firms must focus on their core strategic priorities, leverage in-house capabilities, and seek expert partners in harnessing value across the entire RE lifecycle.

How can Cedar Management Consulting help?

Across the Real-Estate life cycle, Cedar has extensive expertise in strategy formulation, leveraging Balanced Scorecard in transformation (operating model, people, process, and technology), supplier research, negotiation, selection, and Program Management Office (PMO).

With a 30-year track record, Cedar Management Consulting is an award-winning global management consulting firm with deep expertise in strategy and driving performance powered by the Balanced Scorecard. Formerly part of the $1 billion firm co-founded by Prof. Kaplan of HBS, creator of the Balanced Scorecard – the world’s leading strategy formulation and execution framework.

Over the years, Cedar has helped boards, CEOs, and leadership in the strategy formulation and the transformation of their business across sectors and the globe. From global market entry to growth/cost-driven strategies to transform the business and operations from a people, technology, process, products, customers, markets, and financial perspective – Cedar has experienced it all.

We make Strategy & Innovation Work.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View