Indirect Procurement relates to purchasing goods/services not for resale – ones that do not have a direct impact on the product or customer. For example, IT, Contingent Labour, Facilities Management, Professional Services, etc. It represents one of the most under-exploited areas within businesses funding future investments.

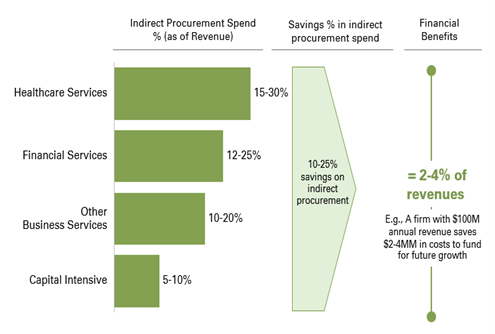

Indirect Procurement spending tends to vary by the nature of sectors. For example, industries that are capital intensive, e.g., manufacturing, mining, oil & gas, automotive, real estate, etc., tend to have a lower share of indirect spending (% as of revenue). On the other hand, sectors like healthcare services, financial services, and other business services tend to have a higher share of indirect spending. As a result, there's an opportunity of 2-4% of revenues that can be realized and re-invested into future growth.

For the right reasons, firms focus on growth and customer-facing activities. However, in doing so, value is lost in other areas of the business. Indirect Procurement is one such under-exploited area facing challenges on four fronts:

- Leadership Focus

- Skillset

- Technology Evolution

- Cross Collaboration

- Leadership Focus: Firms do not have a focused leadership managing indirect procurement within the enterprise. Due to this vacuum, value is lost, and the procurement function tends to operate on a tactical basis rather than as a strategic partner to other parts of the business.

- Skillset: Commonly, businesses consider indirect procurement solely as negotiating the supplier price and generating savings. In doing so, companies lose long-term value, thus creating fragmented spending across locations, business units and suppliers with elevated risk.

- Technology Evolution: Technology is evolving exponentially, quickly shaping future business models. However, procurement has been one of the less digitized organizational functions, resulting in limited integration of ERP/Ariba tools with other systems. This has led to data duplication, manual processes, time-consuming reporting and a less insightful approach to indirect procurement.

- Cross Collaboration: In conjunction with the above challenges, indirect procurement has less integration with finance, other business functions and external partners. Due to limited collaboration or siloed approach, value is lost through the channels and drives higher administrative costs.

The combined effect of the above challenges is material on profitability and, consequently, the business's operating cash flow.

Way Forward

Businesses need to adopt a firm-wide acceptance of the importance of indirect procurement and address the way forward in the following way:

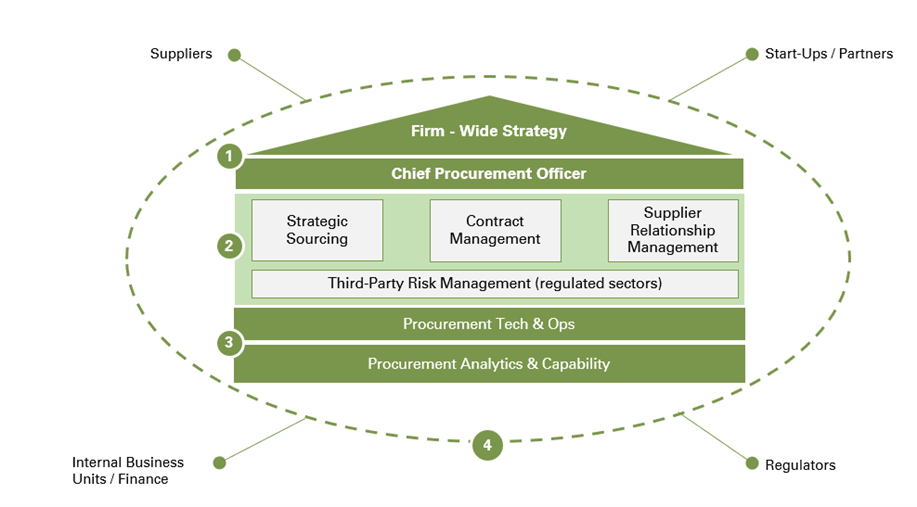

- • Align with firm-wide strategy and establish an operating model: In any organization, a Chief Procurement Officer (CPO) must work along with the Chief Operating Officer (COO) and Chief Financial Officer (CFO). This helps the procurement function remain close to the firm-wide strategy and operate as a valuable business partner.

The CPO's mandate covers all direct/indirect procurement aspects, including sourcing, contract management, supplier relationship management, risk management & compliance, operations, and technology. Depending on the scale and global coverage of the businesses, the CPO is supported by the regional/global category teams to deliver cost savings, service quality, customer experience and risk management.

-

Procurement Know-How: Businesses must continually evolve their procurement and business skills through in-house learning and development or partnering with advisors. The key components to drive procurement-enabled value are:

- Drive spend transparency by building a comprehensive spend baseline across the enterprise by incorporating category/product/service/commodity code hierarchy, general ledger, cost centre and business level information, supplier information, volume and pricing through POs / Invoices, discounts, etc

- by partnering with businesses, identifying needs, and executing Zero-Based Budgeting (ZBB) to challenge those needs and the money spent. Subsequently, an indirect category team maps out the category's supply and demand levers by looking at supplier pricing, market strength and demand management levers (e.g., remove, reduce, reuse, and reinvent). Research shows that comprehensive strategic sourcing and execution yields +15% spending savings in indirect procurement.

- Preserve value and mitigate risk by ensuring compliance with the contractual terms agreed with the supplier and advocating preferred buying channels to eliminate maverick spending (spending outside the firm's authorized buying channels or with non-designated suppliers). In other regulated industries like financial services, third-party risk management is critical in assessing a firm's spending concentration with suppliers, business continuity risk, data protection & security controls, AML/Bribery compliance and regulatory reporting on material and critical products or services.

- Monitor performance through supplier relationship management by segmenting supplier pool by the strategic importance of services procured, greater need for sustainability/carbon footprint, level of supplier spending and global coverage. The segmented approach enables defining and monitoring KPIs in assessing supplier's performance in terms of value creation, value preservation, risk and ESG compliance. This requires a disciplined approach to governance and communication with suppliers and internal business stakeholders.

- E2E Digitisation: In the past, procurement operations and technology functions had seen stickiness to tools like Zycus, SAP Ariba, etc., to manage spend reporting, ordering, and invoicing. Firms have started exploring other toolkits with procurement technology providers offering cloud, single platform, and AI capabilities. However, the technology solutions are not the end goals but enablers to drive value in the businesses.

Digitizing the Procurement function must involve technological solutions that are flexible to any future changes, offer excellent user experience, faster turnaround and are easily integrable/plug and play. The opportunity areas within the digitization of the Procurement function are:

- Establish procurement analyticsand capability function to drive data-driven decision-making and pilot new solutions.

- Automate activities based on repeatability and the need for attended / unattended intervention. For example, Automate spending category classification, Procure to Pay (P2P) payments to suppliers, reconcile invoices and manage cash flow, Blockchain-based smart contracting, Supplier On-boarding/Off-boarding/Know Your Supplier (KYS), Service Chatbots, etc.

- Integrate dynamic discounting features allowing customizable supplier payment terms based on volume.

- Drive Intelligent Analysis & Reporting to generate category insights, savings opportunities, and process automation opportunities.

- Transition towards experiential buying by improving platform/buying channels like the experiences delivered by Amazon, and Alibaba.

- Collaboration: Procurement leadership must remain agile and proactive in working with internal stakeholders across the businesses and external partners like suppliers and start-ups. Transparency, communication and open-mindedness are vital in showcasing procurement-enabled value and its contribution to the firm's success.

How can Cedar Management Consulting help?

Across the procurement life cycle (both direct and indirect), we have the expertise in strategy, leveraging Balanced Scorecard in transformation (operating model, people, process, and technology), supplier research, negotiation, selection, and Program Management Office (PMO).

With a 30-year track record, Cedar Management Consulting is an award-winning global management consulting firm with deep expertise in strategy and driving performance powered by the Balanced Scorecard. Formerly part of the $1 billion firm co-founded by Prof. Kaplan of HBS, creator of the Balanced Scorecard – the world's leading strategy formulation and execution framework.

Over the years, Cedar has helped boards, CEOs, and leadership formulate their strategy and the transformation of their business. This has been across sectors and the globe. From global market entry to growth/cost-driven strategies to transform the business and operations from a people, technology, process, products, customers, markets, and financial perspective – Cedar has experienced it all.

We make Strategy & Innovation Work.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View