There have been about 2500+ new core banking investments made in the last 5 years by banks around the world, according to data recorded in the annual IBSi Sales League Table. More than 20% of these deals have been digital-only deals reflecting the emerging requirements and the changing landscape of the banking industry. More interestingly, half the deals signed in the last 5 years, in the UK, for example, have been cloud-based also providing an indication of changing preferences.

So, what do these developments mean for the adoption of core banking systems in future? More importantly, what are banks likely to seek from core banking solutions as we move forward, and how does one expect these requirements to influence product designs, and manifest in the roadmap of core banking players?

Even as banks tend to focus on the core banking agenda with the twin objectives of being future-ready while optimising costs, the industry has seen a flurry of action over the last few years with the

demand for omnichannel and digital experiences, a higher degree of personalisation, cloud-enabled hosting models, and collaborative integration with fast-emerging open banking marketplace ecosystems. Many of these themes were deliberated extensively at the IBSi NextGen Core Banking Summit 2022 , held in London.

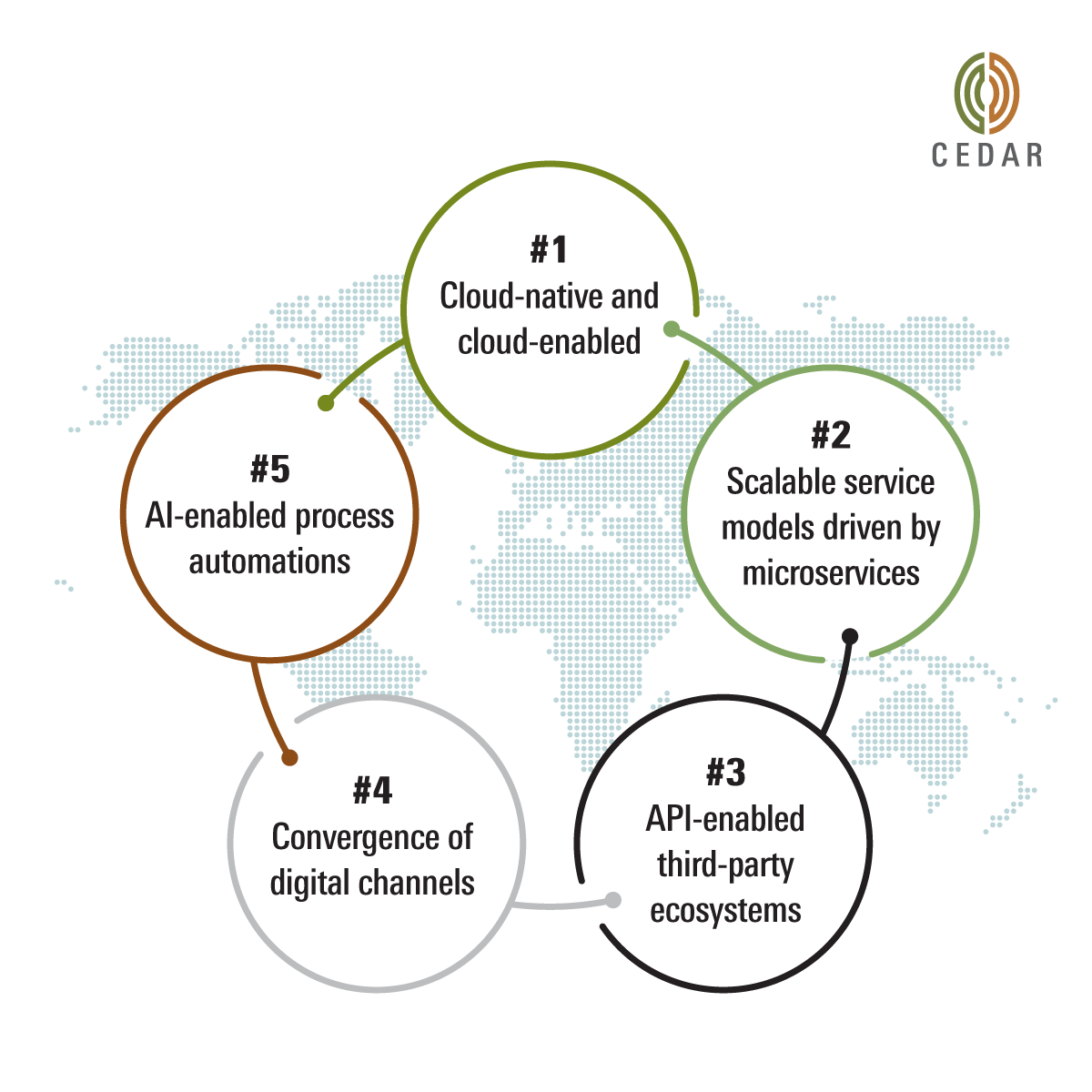

Upon careful reflection, 5 interesting key themes are emerging in the core banking space, reflecting the context of changing customer expectations, and associated trends:

- Cloud-native and cloud-enabled

- Scalable service models driven by microservices

- API-enabled third-party ecosystems

- Convergence of digital channels

- AI-enabled process automations

While the above is certainly not an exhaustive list, these are some of the more prominent trends, that have, in turn, influenced several key initiatives adopted by most players. Let us explore these in a little more detail:

Cloud-native and cloud-enabled

Even as banks are increasingly driving their application footprint to be hosted on cloud, there are a few implications that have set the tone and the direction of the core banking industry:

- Cloud-native infrastructure taking centre-stage

- Regulatory environment conducive to cloud-enablement

- Optimisation of data storage costs

While markets such as UK have seen wider cloud adoption than some of the others that are yet awaiting domestic cloud infrastructure or greater peer adoption (or both), cloud enablement is a pre-requisite for most core banking system selections – also ensuring they can move into the cloud in the future.

Cloud adoption is expected to facilitate scalability and faster response to market requirements. The ability to adopt hyper-scalable infrastructure to process high-volume transactions and the resilience that enables analytical engines to make insightful conclusions in milliseconds holds the key to the effectiveness of cloud-native core platforms. The distinction is becoming more pronounced in the adoption of core by the neo-challenger banks vis-à-vis their traditional counterparts. More importantly, cloud-native platforms are evidently seen to be preferred more with digital-first banks, with containerised deployment.

…it is not the strongest of the core banking species that will survive, nor the most intelligent, but the one that is more responsive to change!

Scalable service models and microservices

Most initiatives driven towards modernisation of legacy systems have been predicated on a common theme – shifting the platform from a monolithic architecture to one driven by microservices, which also allow for scalability and modularity. The corollary to this is the ‘hollow- the-core’ theme, where banks are increasingly seeking to pull features out of the core systems to avail best of breed alternative options. As has been quite evident, industry preferences yet oscillate between a centralised all-in-one universal banking platform, to core systems that are light in themselves, lending to a highly ecosystem aligned API enabled approach. More on this later!

If core banking systems were to truly be hollow, what are they likely to have in them, and what purpose do they necessarily serve? The jury is yet out on this question, although it is typically one of the following three elements, or a combination thereof: (a) the product processor and transaction engine (b) the centralised customer information repository or (c) the general ledger where all transactions converge to provide a centralised financial view.

‘Hollow-the-core’ does not necessarily always mean rip and replace – approaches to delayering have also found takers around the world, who seek to bring in capabilities that are better served by best-ofbreed solutions that may sit outside the core, as part of the enterprise architecture design.

ALSO READ:

Building New Age Enterprise Architecture

API enablement and third-party ecosystems

The bi-directional data flow enabled through API banking now facilitates third-party providers to innovate, create and offer new services in a highly inter-operable marketplace ecosystem. The advent of the FinTech-enabled ecosystem, and the adoption of a collaborative outlook has required banks to be highly adaptive and sensitive to providing personalised experiences to their customers. It is no surprise then, that it is increasingly imperative for core banking platforms to be sophisticated when it comes to being ‘connected’ with this dynamic and fast-emerging ecosystem of point solutions. Enter the Application Program Interface, aka API.

The more pro-active core banking players have been on the scout for on-boarding many such third-party solutions as part of their ecosystem for a while now, thereby providing pre-configured API interfaces, that bring a much higher value proposition to their customers. This gravitation of partner solutions towards the large core banking platforms comes with the twin advantage of ‘ready to-deploy’ API-enabled product portfolio offerings and serves as a differentiator in the value proposition. Simply put, it’s not just about what the product has to offer to the bank, but more about how well it is pre-plugged to the ecosystem of partner solutions. The more, the merrier!

Convergence of digital channels

The single most evident implication for banks of the post Covid-era is the preference and the resultant increased adoption, of self-service digital channels. Both corporate and retail customers are seeking to connect through multiple digital channels directly, requiring consistent and standard service quality. This demand for personalised and seamless experiences has also resulted in the need for the convergence of digital channels, and the benefit of having the digital offering facilitated by the core banking suite itself. The preference of an experience across ‘the channel of choice’ that the customer now wants, necessitates the need for instant configurability powered by scalable processors.

In other words, the core engine that comes with its own native suite of digital channel convergence has its own benefits to the customer, and is expected to deliver better efficiency, as against building a digital layer around a legacy core. However, this need not always be true, as many of the banks with legacy platforms have been seen to innovate on building digital offerings that are enabled by omni-channel hubs that effectively compliment the central core systems.

AI-enabled process automation

Nextgen core banking platforms are meant to be built to keep up with the evolving customer and market dynamics. A very interesting dimension to this is in AI-enabled analytics that helps to drive personalised service offerings, and workflow enablement that has also comes with robotic business process automation features. ‘AI first’ core banking models deliver analytics as a core capability – not as an add-on feature. The agility that AI-enabled data analytics provides, and the agile delivery of services powered by robotic automation, are therefore being looked-to as among the real differentiators of nextgen core banking platforms.

As we move into the next generation core banking platforms, the architecture considerations have evolved not only in terms of flexibility and extensibility, but also in terms of modularity, microservices, and digital ecosystem engagement. Borrowing from the theory that Charles Darwin famously propounded, one could conclude that it is not the strongest of the core banking species that will survive, nor the most intelligent, but the one that is more responsive to change!

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View