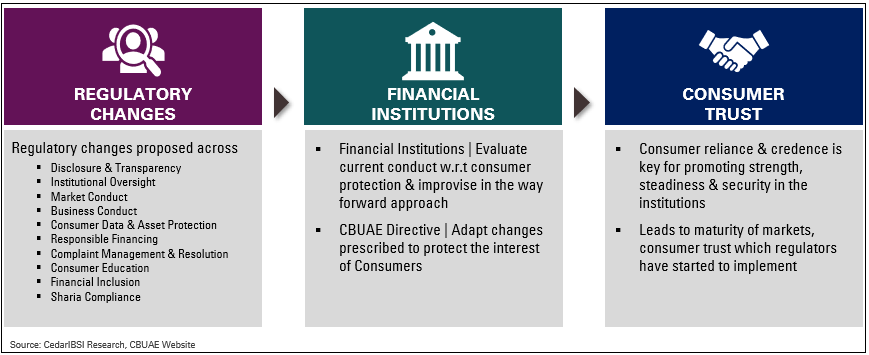

The Central Bank of the UAE (CBUAE) has published a Consumer Protection Standards regulation with the intention to achieve fair treatment and protection of consumers. These, released in Feb 2021, provide an overarching guideline that every Licensed Financial Institution (LFI) needs to induct into their products, process & technology and organization to attain best in class service and highest standards of responsible financial practices.

With the sector growing by leaps and bounds in the UAE, the timing of these regulations will enable growing responsibly, promoting integrity & competitiveness and a establishing a fair playing ground for all players irrespective of the size. Needless to say, the nuances of the relationship between LFIs and their consumers will be elevated.

The Consumer Protection Standards regulation encompasses the following:

Impact & Benefits

Impact & Perceived Benefits to FIs revolve around improved compliance and promoting consumer confidence

Impact on Financial Institutions

- Supervision: Enhanced supervision to identify compliance lapses and mitigate risks

- Enforcement: Increased regulatory imposition and undertaking measures on demeanour

- Customer Experience : Improvement of consumer experience, transparency & involvement with Banks

Perceived Benefits

- Trust: Promote trust, clarity & visibility for customers and institutions

- Technology: Impetus to invest in new age technologies to improve engagement & info. security

- “Safe” Bank: Enhance confidence of consumers as a safe bank to acquire consumers & grow business

CPS | 10 Principles

CBUAE regulations revolve around 10 principles to achieve highest standards of consumer protection. These principles are:

- Management Oversight : Implement & monitor strict oversight across operations and conduct towards customers

- Business Conduct : Teams across verticals to treat customers fairly. Institutions to guarantee the same

- Disclosure & Transparency: Clear & transparent communication across consumer lifecycle

- Market Conduct: Fair playing field with ethical conduct across market

- Data Protection: High degree of security & prudence in dealing with consumer data

- Prudent Financing: Diligent lending & credit policies for improving quality of credit

- Financial Inclusion : Widen reach of financial institutions without any discrimination towards consumers

- Grievance Management: Transparency in effectively & timely addressing of complaints & issues

- Islamic Banking: Sharia compliance in all aspects of consumer lifecycle and protect consumers.

- Consumer Education: Improve education & awareness among consumers

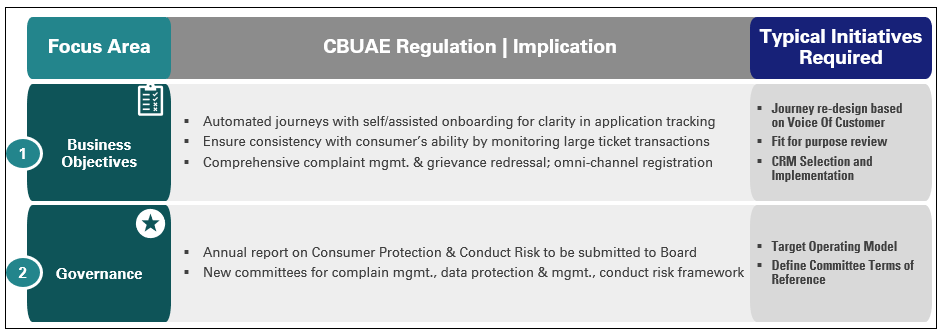

Key Focus Areas

The 6 focus areas of the CBUAE directive on Consumer Protection Implementation are:

CPS | Insights & Implications

Top-down overhaul recommended – Governance, Org Structure and increased focus on Disclosure & Transparency

How Cedar Can Help

Cedar can help in diagnosing areas of concern, strategize on way forward and in its successful execution.

- Diagnostic Review

- Gap Analysis | Compared to CB mandated Future State / TO-BE state

- Fit For Purpose | Specific Review across focus areas with Industry benchmarking

- Way Forward Initiatives

- Technology

- Process

- Organization

- Implementation Plan + PMO

- Plan validation | Review and validate overall program objectives, quality standards

- Risks | Identify risks and impacts, provide executive updates

Identify Way Forward Plan and prioritize initiatives for regulatory compliance around:

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View