Enterprise architectures have been influenced to evolve and transform by the same forces that are impacting any other business practice today. Banks and other enterprises are going through the need to design and re-design their enterprise architecture in an agile way to adapt to changing processes, operating models, changing regulations and tech-savvy customers. The Covid-19 pandemic has forced banks to further assess the capability and scalability of their enterprise architecture setup to meet growing digital demands of customers and regulations such as GDPR, PSD2, and central bank guidelines.

Enterprise architecture challenges are limited for banks born digital compared to those banks that are transforming from traditional to digital, as the latter need to deal with legacy systems and transform on the go.

For years, enterprise architecture was seen as a discipline to define the integrated environment to convert business strategies into IT capabilities. However, in a relatively few years, it can become a problem for organisations, as even a smaller digital initiative may not be able to be rolled out with practical solutions due to complexities of existing enterprise architecture.

Digital transformation requires a high degree of adaptability within the enterprise, which in no way can be bound to traditional enterprise architecture designs and commitments. Traditional enterprise architecture frameworks available for reference, such as Zachman, Australian Government Architecture AGA, TOGAF, DoDAF, MODAF and FEAF, provide guidelines to define the architecture building blocks and integration between them; most of them recommend customising the enterprise architecture design method as per organisations’ objectives to achieve transformation.

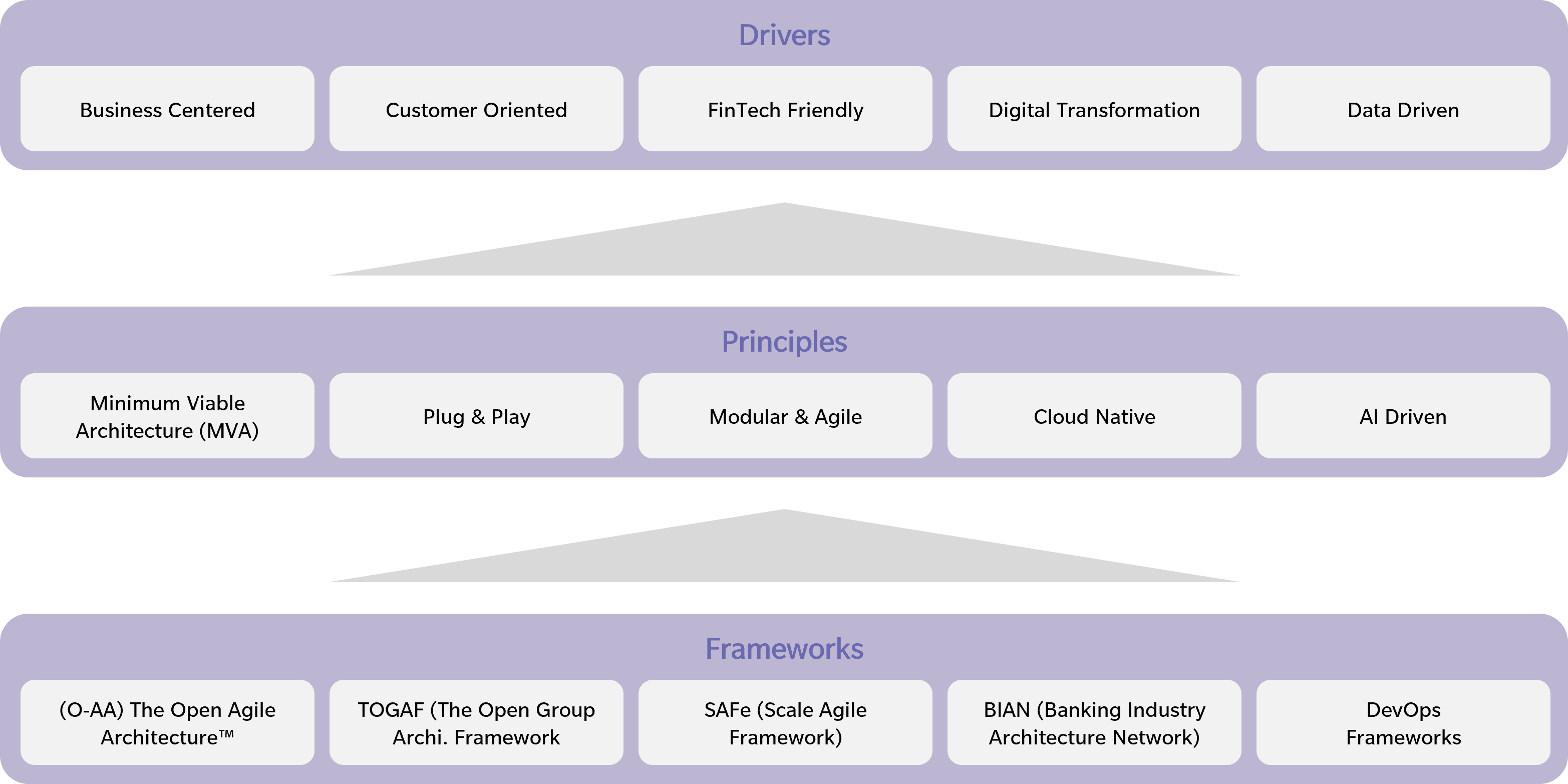

Key Drivers of a New Age Enterprise Architecture Framework

New age enterprise architecture shifts the focus from technology to business, customers, FinTech, digital and data.

Business Centred: Traditional enterprise architectures were IT Centric and were addressing IT needs rather than business needs. Business team members often consider enterprise architecture to be a technical area, which is not the case, rather it defines how various business needs will be addressed by technology and requires IT explaining it in a very simple language. New age enterprise architecture should be focusing on an organisation’s culture, the management, and the business strategy. The business team should be able to function independently, with no reliance on the technical team for day-today functions such as daily reports and getting answers to first level system clarifications.

Customer Oriented: In traditional enterprise architecture systems, the focus is on stability and security, whereas new age enterprise architecture focus on value creation for customers. Customer needs should be inferenced and indirectly observed, without disturbing customer natural behaviour. Enterprise architects must assist to bridge the gaps between what the customer expects and what enterprises deliver. The customer expects value at all stages of the customer journey: before a purchase, during a purchase and postpurchase

FinTech Friendly: Today’s bank operates in a collaborative environment of FinTech Ecosystems, having integration with FinTechs specialised in niche areas such as chatbots, blockchain, artificial intelligence, and loyalty engines to name but a few. Established enterprises are generally not able to build apps as FinTechs do. Thus, enterprises should welcome such apps by provisioning integration of FinTech apps to enhance their offerings by partnering with FinTechs. Several digital banks are providing suppliers with a sandbox environment where FinTechs may register, integrate and test real-life use cases.

Digital Transformation: This enables key capabilities such as straightthrough processing (STP), paperless enterprises, self-onboarding, e-KYC, instant payment transfers and alerts. Enterprise architecture design considers all such capabilities with minimum or no human intervention. Legacy enterprise architecture may support all such capabilities but are likely to require significant customisation and the efforts this would take are unlikely to survive a clear cost-benefit analysis.

Data Driven: Business expects data driven design and analytics. Data has become a key asset to understand customer behaviour, explore new revenue opportunities, cost leakages and security lapses. To build analysis on data, the data must be available. New age enterprise architecture identifies all possible opportunities to capture customer and staff behaviour data, and design ways to analyse that data to provide insights to the management.

Fundamental principles to consider in design

New age architectures are ‘evolutionary in nature’. Evolutionary architecture has no end state and is based on the concepts of continuous integration and continuous development, enabling architects and developers to keep building and integrating various components without impacting the foundation building blocks.

Minimum Viable Architecture (MVA): Minimum viable architecture is based on the term ‘Minimum Viable Product’ (MVP) coined and defined in 2001 by Frank Robinson and then popularised by Steve Blank and Eric Ries. New age enterprise architecture design methodology must initiate architecture design as MVA and continuously improve the architecture over time. Working in this way avoids the expense of ‘build and burn’. MVA is adequate to launch a product or a service.

Plug & Play: The Open Agile Architecture™ (O-AA) framework by the ‘The Open Group’ provides guidelines on the ‘plug and play’ features of the new age enterprise architecture. Enterprises should designcomponents at need, plug them into current architecture, upgrading or replacing at any point of time. The collapse of such components has no impact on the overall enterprise, which remains operating with other functionality.

Modularity: New age enterprise architecture must think modular, loosely coupled, with continuous integration and continuous development. It needs to be loosely coupled and modular, to help the enterprise respond more quickly than traditional approaches. Modularity will assist in sunsetting legacy systems over a time. Modular components are self-sustained, independent, SOA (service oriented architecture) building blocks.

Cloud Native: Cloud native enterprise architecture is cloud/ technology neutral and can be mapped to any cloud platforms such as Microsoft Azure, Amazon AWS or Google Cloud Platform (GCP). Microservices within a cloud native platform help to build and deploy smaller and independent services. Microservices interact with each other through APIs. Interdependent microservices and their APIs are bundled together and shipped as containers. Docker, Kubernetes, and OpenShift are popular container image formats. It alsoprovides immense operational and financial flexibility due to the ‘pay per use’ infrastructure model and the provision to scale up or scale down within seconds. Such flexibility allows banks to prioritise and focus on design aspects of the enterprise architecture rather than worry about security and set up.

Highly Agile: Current enterprise architecture development methodology (ADM) is a linear and sequential approach, whereas new age enterprise architecture adapts to an incremental and iterative approach of build, use, increment build, use and so on. Heavy design upfront may prevent small components to plug in and adapt to quick changes. Emerging technologies and products deployed in the enterprise have shorter release cycles and allow the enterprise to be flexible enough to rapidly deploy such components.

In September 2020 The Open Group published The Open Agile Architecture™ (O-AA), an enterprise architecture framework designed to support enterprises through dual agile and digital transformation initiatives. O-AA provides guidelines on the key components of new age enterprise architecture frameworks and is an ideal head start for enterprises beginning their new age journey.

Other frameworks enterprises should consider while designing their enterprise architecture frameworks includes TOGAF (The Open Group Architecture Framework), SAFe (Scale Agile Framework) BIAN (Banking Industry Architecture Network) and DevOps.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View