Indian Hotel Industry - Background & Key Trends

The Indian Hotel Industry is on a high. Occupancy Rates (OR) have reached 70% levels vs. ~50% five years ago. Revenue per Available Room (RevPar), the key metric which the hotel industry uses to measure performance is at Rs. 2,990* per room night, a whopping 19% CAGR over 5 years. Average Room Rate (ARR) too has grown by.10% CAGR to Rs. 4308* per room night.

Unlike other businesses which are largely dependent on demand from the local population at their location, the hotel industry is unique in that it is dependent on transient demand i.e. people who are transiting through or visiting a city/town. Thus the factors that contribute to hotel industry growth are those that result in increased travel of people. In the Indian context, primary among these over the last couple of years have been:

- A booming economy growing at 7-8% p.a. leading to increased business travel

- Growth in tourism of 17+% vs. previous year

- 25% pa growth in the ITES/BPO sector and emergence of new IT/BPO development focused cities & towns

- Changing consumer attitudes & aspirations leading to increased lifestyle spending

- The emergence of budget airlines that has not only put the power of fast & convenient travel within the common man's reach but has also led to a larger number of cities and towns now being connected by air

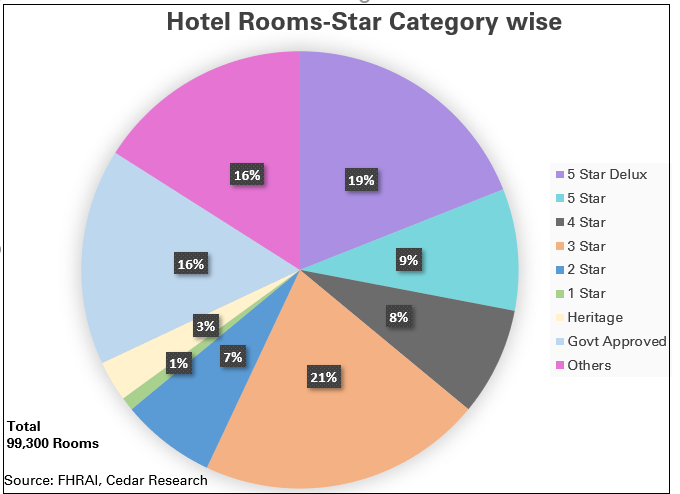

- Being cyclical in nature, the industry has gone through its share of ups & downs in the past. What is strategically different about the upswing this time around is that it is across all star categories from 5 star hotels to non-star hotels. Traditionally perceived as the domain of the rich, the industry's past organized growth & expansion has largely been in the luxury segment i.e. 5 star and 5 star deluxe hotels. So strong has been the focus on this segment that even for the common man top of mind brand recall is of a Taj, Oberoi, Sheraton etc. all key players in the luxury segment. Ironically, the luxury segment constitutes less than a third of the current room inventory in the country as highlighted in Figure below.

Mid Market Hotels - Trends & Opportunities

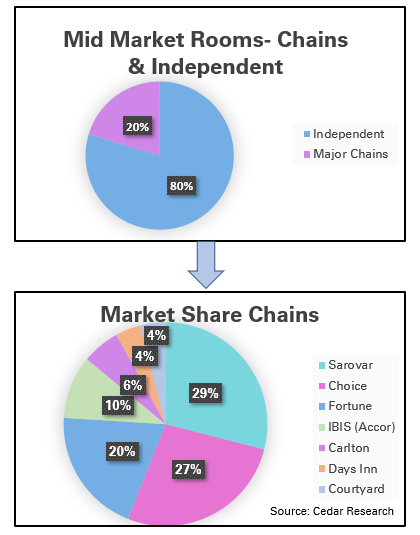

Growth has been robust in the budget (2 star & 1 star) and especially in the mid-market segment constituting 3 & 4 star hotels. Historically the mid-market segment has been run by independent owners with chains forming only 20% of the nearly 30,000- rooms inventory (Figure below).

Rapid growth has for the first time built-up to a shortage of rooms in the segment and has caused a flurry of activity with both domestic and international players scrambling to set up new mid-market hotels (Table 1).

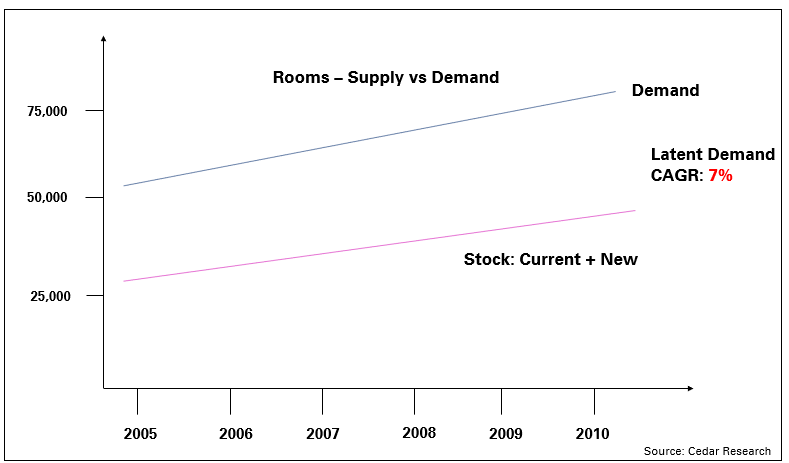

Cedar research & analysis reveals that inspite of new stock being added, there will exist a latent demand of 38,000 rooms even in 2010 (Figure3).

This represents a tremendous opportunity for anyone wanting to enter this segment. However, it is important to analyze the opportunity strategically and identify the key issues and critical factors for success.

Mid-Market Hotels - 5 Strategic Factors for Successful Entry

Targeting the Right Customer Segment

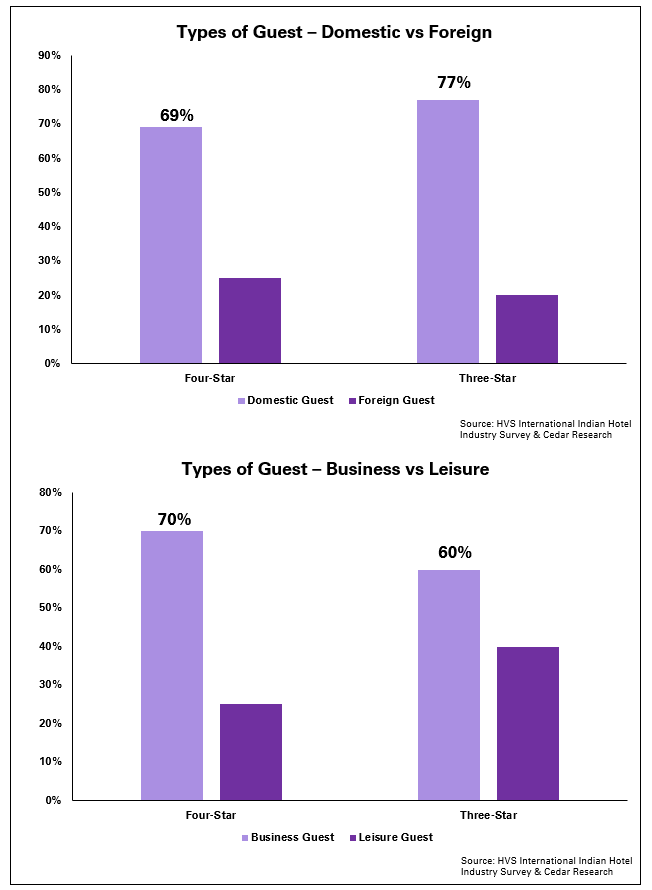

Industry surveys indicate that more than two-thirds of midmarket hotel guests are domestic business travelers (Figure 4) clearly identifying the target segment.

Cedar research has further determined that it is Middle Managers of large corporations & Senior Managers/Owners of Rs. 50-100 crore companies who frequent mid-market hotels. Therefore it is critical to success for a new entrant to devise hotel offerings and marketing & promotions to target this customer segment.

Identifying the Right Locations

Property costs and land availability are key entry barriers to the hotel industry. This is especially true of metros like Mumbai & Delhi. The current midmarket hotel boom coupled with the entry barriers has led to numerous p r o j e c t s b e i n g a n n o u n c e d a n d developed in smaller t own s & c iti e s. There is a need to proceed with caution on this front. Not all non-metro towns are either existing or developing business centers. For a mid-market hotel to be successful in a town, it has to have significant transient population of middle managers. Cedar research has revealed that 70% of domestic business travel in this segment is still limited to the 8 metros and 27 minimetros in India.

Within the subset of 35 metros & mini-metros, it is important to strategically asses the following:

- The actual site - proximity to business center, airport, other hotels etc.

- Competitive Scenario - Other mid-market hotels, prevailing OR, ARR, other upcoming projects etc.

- Latent demand and future potential sustainability of entry

- Infrastructure and regulatory framework & support - air/rail connectivity, taxes, licenses, availability of manpower etc.

Designing a Competitive Offering

Table 2 compares the global benchmarks of offerings in a luxury, mid-market & budget hotel.

The conventional way of determining the amenities & facilities to offer is based on following the benchmarks in the table above, size of property and budget for capital investment. Thus the final offering ends up as either run-offthe-mill or with mismatched consumer needs.

The strategic approach would be to design the offering based on assessment of target segment needs i.e. middle managers/business owners. Today's Gen X business traveler is technology savvy, health conscious, convenience oriented, experimental & demanding of high standards.

The offering therefore needs to be:

- Innovative - decor, service, automation of facilities etc.

- Value driven - aligned to business traveler requirements & unmet needs

As an example, wi-fi internet would be perceived as a high value offering by most managers in the target segment. Similarly choice of personalized newspaper and iron-boards could be perceived as having convenience value. On-line reservations & meeting rooms could be perceived as innovative and convenient. On the other hand, a standing shower cubicle in lieu of a standard bath-tub offering may not impact the business traveler but can lead to substantial savings for the hotel.

Finally, the mid-market segment historically, has made a limited effort in brand-building. As the segment becomes more competitive, sustained brand building efforts tied into product & service offerings would provide long term leverage vs. competition. Innovations like loyalty programs & interactive websites would not only build brand but also significantly enhance the service offering.

Providing Best-in- Class Customer Service

Traditionally only the luxury segment was associated with world class service levels. However, the Indian consumer has been exposed to high levels of service and demands the best in everyday life. Emerging retail formats, multiplexes, F&B outlets like Barista have all created new levels of service expectation in the consumers' minds.

For a mid-market offering this would translate into providing service level quality similar to , if not the same as that in the luxury segment. The strategic challenge therefore lies in recruitment, training & retention of manpower to sustain a high quality service offering.

The challenge is particularly pronounced as the service sector is growing at a scorching pace and there is dearth of talent across the service industry, be it BPO, hospitality, food service, retail etc.

Another challenge is to find and train suitable manpower in non-metro towns mini-metros & eventually in Class I towns.

Investment in manpower recruitment & training to offer best-in-class service levels would differentiate the midmarket offering initially and provide sustainable competitive advantage in the long run.

Creating a Robust Financial Model

At the end of the day, it is ultimately about delivering a sustained, healthy bottom line and a strong Return on Investment.

A critical factor to deliver this is to figure out the targeted OR & ARR at the project feasibility stage. The prevailing competitive rates in the targeted city and the emerging economic development in the city are key indicators of this. The revenue projections based on the targeted OR &ARR should allow for the desired ROI and profitability.

Another critical aspect is to judiciously manage the initial capital outlay by designing the property for maximizing utilization of space and through proper selection and negotiations with vendors, government authorities (for regulatory tax sops etc) and contractors.

Finally, to keep the business operationally healthy, and minimize fixed costs, outsourcing of services & back-end manpower should be undertaken.

Conclusion

Significant window of opportunity does exist for entry in the mid-market hotel segment in India, and early movers do have a clear advantage. However, the key to success is a function of determining the right target segment, zeroing in on the right locations, building a best-inclass offering, building a sustainable customer service model and structuring a viable and successful financial model. Obviously, each of the above is inter-linked, and best results are obtained only if all of them are aligned with each other, and with the overall business strategy. While there are enough opportunities to tap, it does take a careful and judicious call on strategic imperatives critical for the organization to make it a truly successful model in the long run.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View