As the world comes to terms with social distancing and business and consumer

alike embrace remote operating, there may be a distinct silver lining in all of this

for banks: the “digital panacea”

Much has been said and written about the Coronavirus and its global impact. The new world order of social distancing and the touch-me-not code of conduct has also brought significant changes to the way services are rendered and consumed. The lockdown has a direct impact on the supply chain, and reduced consumption will have a substantial bearing on the cashflows of most industry players, and therefore, their repayment abilities. Which also implies that NPA and provision levels are bound to rise, directly impacting the bottom lines of banks. The steep fall in banking stocks around the world is testimony to that. So, what can banks really do?

Even from a preliminary outlook, there may be a definitive opportunity for banks to turn around and make a rapid adoption of the “digital mantra” that seems to be the panacea to all the above perils. The implications are quite obvious: beyond the immediate business continuity planning (BCP) and the project portfolio prioritisation that is keeping most technology functions busy around the world, there may be some important short-to medium-term initiatives that banks would need to adopt. These include opportunities that may make the most of this “black swan” event, where both the business and the operating model has the opportunity to make a permanent shift into the digital mainstream.

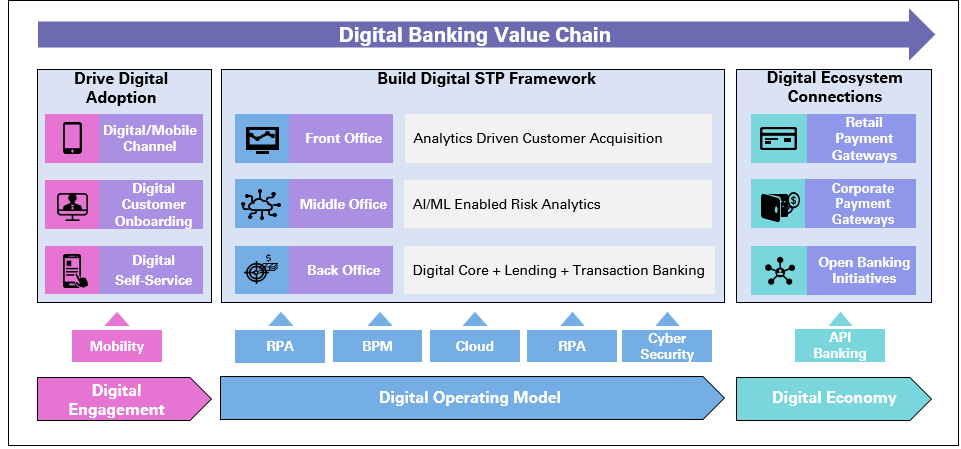

There are 3 key areas that banks may need to explore as part of the digital value-chain, from the standpoint of this quick shift into the digital mainstream:

1. Driving Digital Adoption | Enhanced Customer Acquisition

This is about ensuring that existing customers are moved significantly into self-service channels that are digital enabled and that facilitate a strong digital on-boarding experience. This applies both for individual as well as institutional customers.

2. Build a Digital STP operating model | Improved operating efficiencies

Having the customer channels alone digitised is simply not enough. It would be essential that the bank’s enterprise architecture be enabled for straight-through processing (STP) and robotic process automation (RPA), that allows for end-to-end digital enablement.

3. Connect to the digital ecosystem | Institutionalised sustainability

The livelihood of a digital banking ecosystem is not dependent just on the digital onboarding of customers and having the target operating model digital. It is significantly reliant on plugging into the digital ecosystem, which includes payments and open banking enablement through Application Programming Interfaces (API)

Unless all three elements are sufficiently digitised, the benefits do not accrue completely. While the revenue driver is highly dependent on customer acquisition, cost efficiencies are gained through optimising the operating model, and the participation of the bank in a digital ecosystem is key for long term sustenance.

Driving digital adoption:

The current Covid-19 pandemic has created 3 distinct challenges for both banks, and their customers.

- When in a lockdown, how would a bank branch be of value? Contrarily, how does one staff the branches, which obviously needs manpower on the ground.

- With the social distancing norms vociferously implemented, how does one avoid handling of cash, that obviously changes hands?

- In the long run, how does the bank expand its customer base, without necessarily having to deploy feet-on-street?

Necessity is the mother of invention. Fortunately, “digital” offers a powerful answer to all of the above. While the pundits may continue to deliberate on the need for physical branches and the value from a servicing standpoint, the order of the day, in times of social distancing, is digital. Be it with retail customers – where one could on-board, deposit, borrow, transfer, pay bills and operate the account through the mobile channel, or with corporate customers, and particularly with transaction banking, where institutions may self-onboard, transact, manage liquidity, transfer funds, pay their employees and also interact with a virtual RM – all digitally. Here are four important imperatives that banks may need to implement, in order for the above to be well executed:

- Mobile / digital channel platform with best-in-class user onboarding experience

- Digital corporate banking platform, with a focus on transaction banking

- Tight integration with back-end systems, allowing for digital fulfilment

- Powerful customer analytics, identifying cross- and up-sell opportunities

Building a digital STP operating model

Having the customer on-boarded, or getting a cross-sell offer subscribed to, or having the customer initiate the request digitally, without having to reach out to the branch is just one part of the story. The more important aspect of any digital enterprise architecture is in the ability to have end-to-end fulfilment executed without manual intervention.

A typical service-oriented architecture would need to allow for all services of the bank – retail, corporate, cards, trade and wealth management to be able to operate and execute digital instructions that emanate from the digital channel with zero or minimal manual intervention. This would need to be across all the products that the bank may offer across both asset and liability accounts, and fee-based services. With geography soon becoming history, it is not critical for banks to have a large branch footprint to offer transaction banking services. Digital on-boarding and segment-based customer journeys and digital transaction banking adoption has allowed for Tier-2 and 3 Davids of the banking industry to take on the Tier-1 Goliaths on a new level playing field.

That said, the key here is to drive operating efficiencies. And those don’t get built without building a strong robotic process automation engine (RPA) and a strong inter-operable technology architecture. The operating engines that host these services are increasingly hosted on the cloud, thereby also enabling minimal physical footprint. The corollary to this would obviously be having a robust cyber-security framework, the shield to guard from yet another virus from outside!

Connect to the digital ecosystem

The digitisation picture won’t be complete unless the bank also plugs into the larger digital ecosystem, as bank-to-bank transactions also need to be executed, settled and reconciled in a seamless manner. This not only includes corporate payments and institutional gateways, but also gateways for cards, SMTP and FTP, clearing houses and other retail payments.

More importantly, the ability to provide a larger canvas of inter-operable value-added services to customers will clearly depend on how well the bank adapts itself with an API enabled open banking model. The PSD2 directive and regulations have already made banks move in this direction. It may not be enough to “also” offer an open banking environment, but gear change may be needed to make this mainstream, as banking metamorphosises into a “financial marketplace”.

In essence, the Covid-19 pandemic may help to speed and accentuate what was already the inevitable: migrating both banks and customers into the digital paradigm. Old habits typically die hard, but these are days where the world is looking to embrace new habits. Banks would certainly do better not to miss this “black swan” train!

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View