In today's competitive environment, getting your strategy right has never been more important. Yet research shows that most companies fail to execute strategy successfully. Cedar offers a roadmap to reverse this trend. The Balanced Scorecard is a tool that reveals gaps between vision and action. Unearth these gaps in your organization.

Here are some cold hard statistics: fewer than 10% of effectively formulated strategies are successfully implemented. A fortune cover story on failures concluded that in about 70% of the cases the real problem was not bad strategy but bad execution.

In India, we estimate the failure rate of the best strategies to be between 70% and 90%.

Most management systems revolve around a budget. The question “Is this within this year's budget.” is more often heard than “Is this in our strategic plan?” Organizations often give up activities as the year goes by if the budget needs to be pruned, without realizing that some of those activities may be crucial to reach strategic objectives.

Linkages between strategic objectives and action plans are often weak.

When the organization hits the strategic planning cycle one or more of these usually happen:

- Not all key people participate in finalizing strategy

- Divisions/SBUs do not finish their strategic plans or even action plans in time for corporate strategy to reflect all key priorities comprehensively

- The long-term strategic planning exercise does not end on time

- The budget is treated as the strategic plan

The problem is not that organization can't formulate strategies. Rather the issue is that the task of implementing strategy is time consuming, and riddled with vested interests, ambiguity, even lack of acceptance of the strategic plan. The strategy document remains isolated, 'for your eyes only'.

The Balanced Scorecard (BSC) framework successfully addresses these problems. It focuses on shareholder, customer, internal and learning requirements of a business in order to create a system of linked objectives, measures, targets and porjects which collectively describe the strategy of an organization and how that strategy can be achieved. In the process of creating a BSC, four perspectives (financial, customer, internal process and learning and growth), capture the roles, tasks and priorities of the various divisions and individuals.

Three Steps

1. Build a Strategy Map

The first output of a BSC project is a strategy map. It shows the top 20-25 objectives that the organization needs to focus on to deliver its strategy. Financial objectives are critical to the existence of all organizations.

However, to deliver these financial outcomes, the organization must determine which customer needs have to be met, and what internal processes are critical for delivering their expectations. Finally, managers need to work out what the organization must learn in order to carry out the core processes efficiently and effectively.

Even though the concept of the BSC is simple, it's difficult to develop because managers are used to thinking operationally and for the short-term rather than strategically. The BSC usually reveals gaps in strategy.

2. Create a BSC

The next step is to define the metrics needed to measure the success of a strategy. Both financial and non-financial measures are identified. Approximately 30-40 lead and lag, measures are identified, and a significant effort is made to ensure that there are enough lead measures so that the BSC created allows the organization to actively manage the delivery of the strategy.

Owners are identified within the management team so that there is collective ownership and responsibility in delivering the strategy. Actual performance is computed, and the targets for delivering the strategies are set.

Care is taken to set breakthrough and stretch targets in select areas where benefits could be significant, balancing it out with more realistic targets for other objectives.

Lastly, internal projects that often tend to lose sight of what objectives they need to achieve are identified, prioritized and aligned to the business objectives they will help deliver. The BSC is created at the group/corporate level but many organizations that want to ensure that the corporate strategy is detailed at the operational level will build cascaded scorecards for all business units and for some or all support functions.

3. Use the BSC

Once a BSC is designed, it takes about 60-90 days to take it 'live'. Actuals and targets need to be set, and internal BSC coordinators need to get organized for monthly reporting of the scorecards.

The BSC is then used actively in the monthly management committee or the operational, committee meetings to find solutions and improve performance in areas where the BSC identifies where business targets are not being met.

In some cases, automation software is purchased to improve the case and quality of reporting, but in many cases, for the initial period, companies use simple excel formats.

Abbreviated versions can also be created for quarterly reports to the board of directors, and key themes can be identified for communication across the organization. The BSC should be reviewed yearly, in the third quarter of the financial year.

BSC, Planning and the Budget

Managers use budgets to accomplish several vital organizational functions:

- Establish performance targets

- Allocate resources to enable those targets to be achieved

- Assess performance relative to targets set

- Update the targets based on new information and learning

If the budget is used as the primary means of controlling the company, management's attention invariably becomes riveted on achieving short-term financial targets.

When using the BSC to integrate their planning and budgeting processes, companies can overcome important barriers to strategy implementation.

The budget transforms from a mechanical and tedious exercise, focused on short-term financial numbers into a management tool that directs attention and resources to critical strategic initiatives. The operational budget, handled through an activity-based budgeting process, authorizes resources supply and spending based on anticipated demands for work and forecasted process efficiencies.

This budget can be made dynamic, allowing for changes in the environment, new opportunities and competitor actions. The strategic budget, on the other hand, focuses on decision about new discretionary funding and the assignment of critical human and capital resources to new initiatives.

The decisions are taken in rigorous reviews using the BSC as the lens by which initiatives are proposed, ranked and selected. The process also generates short-term performance targets across all BSC measures, financial as well as non-financial, for which employees are held accountable and compensated in upcoming periods.

Like the BSC, activity-based budgeting is conceptually simple to understand yet difficult to implement. The organization has to specify far more detailed estimates than it would in conventional budgeting. When done successfully, it is truly bottom-up.

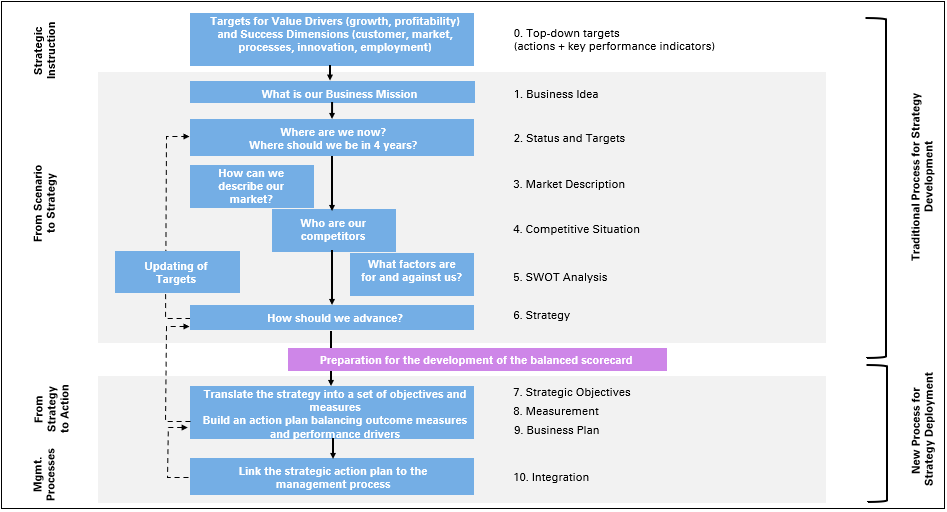

Example Asea Brown Boveri’s Strategic Planning Process

It gives managers the opportunity to identify where excess resource capacity already exists and to take steps to redeploy or dispose of the resources (equipment, facilities, people) that are no longer needed in the forthcoming periods. Many spending decisions can be determined using the following sequence of steps.

- Estimate the production and sales volumes for the next period. Activity-based budgeting starts, as in a conventional budget process, with estimates of production, sales volume and mix of products and customers. The sales estimates must include not only the products that will be sold but also the customer expected to buy them. Production and sales budgets need to be far more detailed than conventional ones. For example, the production budget must include information about the processes that will be used to achieve the total production volumes such as the expected number of runs for each product, the frequency of material orders and receipts, and the method of shipment. For customers, estimates of the number of orders placed, average order size, and number and intensity of customer contacts are important inputs to forecast the demanded level of customer support activities.

- Forecast the demand for activities: Conventionally companies construct detailed budgets only for activities such as materials purchasing, labor time and machine time. Activity based budgeting extends this analysis by estimating demand for all activities required to make, market, sell and deliver products.

- It forecasts the demand, for example, for ordering, receiving and handling materials, developing new products, selling to customers, and maintaining relationships with customers.

- Calculate the resource demands: Activity-based budgeting then estimates how many and what types of resources will be needed. It is at this step that the company uses information about next period's activity and process.

- If the company forecasts process improvements, the demand for resources will be modified downward.

- Determine the actual resource supply: The activity-based budgeting process concludes by converting the demand for resources into an estimate of the total resources to be supplied. In general, each resource has a particular profile. These range from very flexible (like hourly rate), to committed and fixed (like plant floor space). For most companies this will be a complex and iterative calculation. Establishing an activity's capacity will require looking into sales order patterns; production, purchasing and shipping schedules; resources that can perform multiple activities; and seasonal demands for activities.

A Battle Half Won

The focus on achieving the strategy defines priorities across multiple entities and suitably allocates resources.

Divisions, strategic business units and departments can retain their individual priorities yet know their contribution and role in the overall strategic framework.

Some divisions would contribute to revenues, some to profits, and some to long-term growth and hence their financial/customer/process/organizational focus can be defined more clearly.

It is not uncommon for a divisional head to ask for funds to grow even though a doubling of that division's turnover would not help significantly in overall revenue growth.

Thus, successful strategy is driven by a strong alignment of people, functions, infrastructure, activities and information in an organization.

The roadmap must address all these elements comprehensively so that steps towards strategy implementation are tracked, appropriate mid-course corrections made and the contribution of the entire organization is well integrated.

The achievement of the strategy is owned by all and not just by the top management. Hence an aligned approach is half the battle won.

To read more such insights from our leaders, subscribe to Cedar FinTech Monthly View